The Last Mile of Disinflation Might not be that Difficult

Inflation rates in the euro area and US increased sharply in 2022, in part following large energy price shocks. This column analyses the pass-through from energy prices to core inflation since the 1970s for the US and Germany. It shows that this pass-through is not constant over time, but time-varying. Pass-through from energy to inflation during the 1970s was high in the US, but not in Germany. Both countries experienced high pass-through in 2022, but this has declined in the most recent quarters, consistent with a return to more normal inflation dynamics.

The second and third quarters of 2023 have seen a rapid deceleration of inflation in the euro area towards the ECB’s target rate of 2%. The US has experienced a similar reduction, but concerns remain about potential persistence in core inflation, and questions are raised about how to achieve ‘the last mile’ (Schnabel 2023). Indeed, some research based on historical examples of cost-push inflation suggests that continuing a hawkish attitude might be advisable to avoid a bounce-back (Kammer et al. 2023). Others point to stable long-term inflation expectations allowing for a more dovish approach to monetary policy (Guerrieri et al. 2023).

We contribute to the debate by looking at the lessons from previous energy price shocks, especially from the 1970s, and distinguishing two different regimes: one in which the pass-through from energy prices is low, and one in which the pass-through is high.

This investigation is motivated also by the observation that, at least for the US, the energy price shock of 2022 was not much different from previous episodes since oil prices were not higher in 2022 than in 2013 or 2008, but there was no spike in core inflation during those periods.

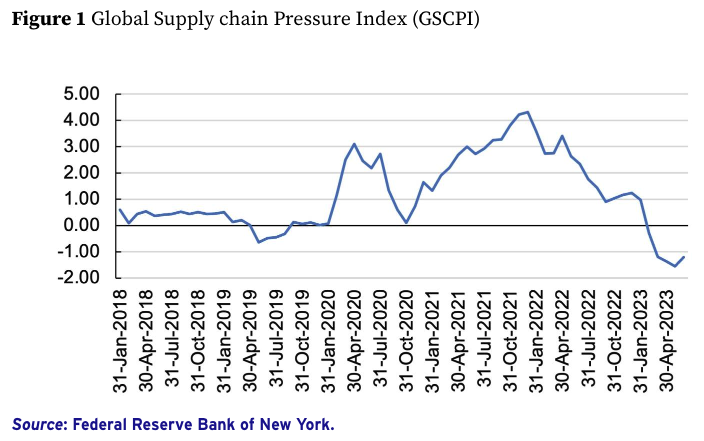

Despite this observation about past oil prices, there is general agreement that one of the key drivers of the recent inflation has been energy (Dao et al. 2023). Yet energy was certainly not the only driver of inflation. The rapid re-opening of the economy following the Covid lockdowns and supply chain shortages significantly contributed as further cost push factors (see Figure 1).

However, supply chain disruptions were different, as rather than leading to sector-driven inflation like energy, they created a divergence in durable goods versus services inflation. This phenomenon was not present in past inflation episodes, thus rendering this episode not comparable with past ones. Moreover, as Baldwin et al. (2023) show, the nature of supply chain links has changed, increasing the exposure to global shocks. We thus concentrate on energy.

Source: Federal Reserve Bank of New York.

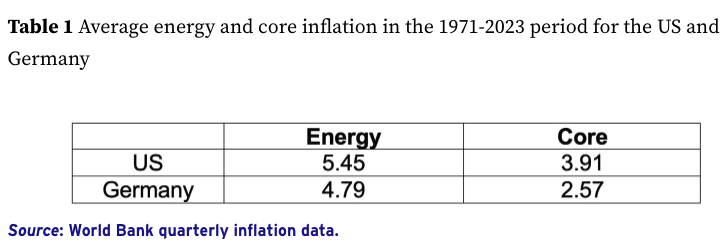

The key problem for policymakers is not so much the behaviour of energy prices per se, but the pass-through rate from energy to core (non-energy) prices. Energy prices are known to be volatile. What is less known is that they have constituted a source of inflation over the last 70 years (and during most sub-periods one could think of). Table 1 shows the average of energy price and core inflation for the two economies we look at more in depth (the US and Germany).

In the US, the average increase in energy prices has been close to 5.5% (annual) since 1971, 1.5 percentage points higher than core inflation. In Germany, core inflation was lower, at 2.6% on average and energy prices (expressed in deutsche mark and then euro) increased less than in the US due to the appreciation of the deutsche mark, but were still 2.2 percentage points higher than core inflation.

Energy prices have thus constituted a potential driver of inflation for 70 years. But their importance varies over time. Our key hypothesis is that the rate of pass through, i.e. how much core inflation responds to changes in energy inflation, might vary over time. We concentrate on the idea that there might be two different regimes: one with high and another one with low (not necessarily zero) pass through.

The key motivation for these two regimes is the concept of rational inattention (Maćkowiak et al. 2023). When inflation is low, rational agents assume that they need not pay much attention to prices. The prices of non-energy goods producers and wages might thus remain constant as long as energy prices do not become salient enough. However, when energy prices and maybe others increase drastically, agents might pay much more attention to them and adjust their own price and wage setting accordingly. The price increases due to supply chain disruptions in 2022 might have provided one such trigger.

To recover the parameters of both regimes we run a Markov-switching dynamic regression on the evolution of core inflation, using quarterly data going back to the 1970s to include all oil shock experiences.

We performed a similar analysis using data from the еuro area and a smaller sample since there is no data for the euro area tracing back to the 70s, that confirms the pattern post-Covid (Galeone and Gros 2023).

The main exogenous variable is energy inflation. The lag of previous-period core inflation is also included to account for the slow-moving nature of core inflation.

We perform this analysis for two key economies: the US and Germany (data for the euro area are not available so far back).

The regression identifies, for both countries, two regimes: one characterised by a lower average core inflation rate and a low sensitivity of core to energy inflation (motivated by rational inattention); and one with a larger average inflation rate and a much higher sensitivity of core inflation to energy prices. The latter is the key parameter of interest for us. We call the first regime ‘stable state’ and the second regime a ‘high pass-through state’, in which energy inflation is passed along to core inflation much more intensely.

In the case of the US, the regression yields a sensitivity of core inflation to energy prices more than ten times larger than the ‘stable state’. In the case of Germany, the ratio in the parameters high pass through versus stable state is around five times. For both countries the significance of the estimated coefficients is highly significant, with p-values lower than 0.01. The data thus identify two clearly different regimes.

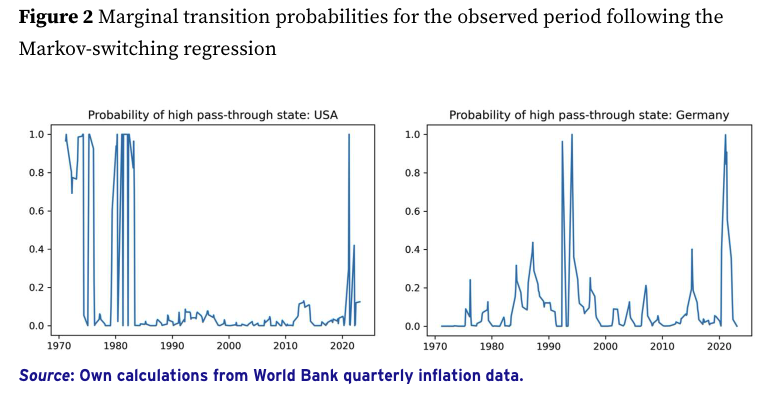

The method we used can also be used to compute the marginal probabilities of being in either state. We concentrate on the evolution of the probability of being in the high pass-through state. Figure 2 shows side by side the results for the US and Germany.

For the US, the probability of being in the high pass-through regime is clearly associated with the oil shocks of the mid- and end-1970s and the early 1980s. This confirms the standard narrative of inflation driven by energy prices during this period.

However, for Germany the results are very different. The stable state resisted these energy price shocks. The reason was presumably the uncompromising anti-inflationary stance of the Bundesbank. This shows that high energy prices do not necessarily have to lead to a high pass-through state if policy is determined enough.

German (core) inflation thus shows a very different historical relationship with energy prices than the US. This difference vanishes, however, during the recent past, with both countries entering quickly the high pass-through state in 2022 and early 2023.

Our results also suggest that over the last quarters inflation has returned to the stable state in both economies. This would be good news because it would imply that the last mile of inflation should not represent particular difficulties, as central banks could again rely on the mechanisms that determined inflation before the energy price shock.

Conclusions

This analysis adds a key fact to our understanding of inflation pattern. Energy inflation does not affect other prices always the same way. There can be long periods during which energy prices go up and down with little impact on non-energy prices and others during which energy price increases lead to sharp increases in core inflation.

The idea that rational inattention can insulate the economy from some shocks and thus impact monetary policy is not a new one (Sims 2010, Miranda-Agrippino and Ricco 2021). We argue that in times of high energy price volatility the anti-inflation credibility of the central bank becomes even more important in preventing a switch away from the stable state to a more instable one in which agents pay more attention to prices and become more prone to revising their prices.

However, our results also imply that when energy prices stabilise, as they have in the past few months, 2 one should expect a return to the stable state and a return of core inflation to the previous level.

Naturally there are some differences across countries, due to the difference in energy price paths (reflective of the energy mix).

In the US, oil prices have returned to a level close to the pre-pandemic levels (in the third quarter of 2023 the WTI index was 31% higher than the 2019 average price).

The situation is somewhat different in the EU, where natural gas price increases are much more consequential. They have decreased from the 2022 peak but remain high, as in the third quarter of 2023 TTF Dutch futures were still about 2.8 times higher than the pre pandemic average.

As visible from Figure 2, both Germany and the US seem to have reverted to the stable state in the summer of 2023.

Current inflation figures are already closer to the central banks’ target than most experts just a few months ago believed it would be by the end of the year (Ambrocio et al. 2023).

The last mile might thus not be that difficult.

This column was originally published on VoxEU

IEP@BU does not express opinions of its own. The opinions expressed in this publication are those of the authors. Any errors or omissions are the responsibility of the authors.