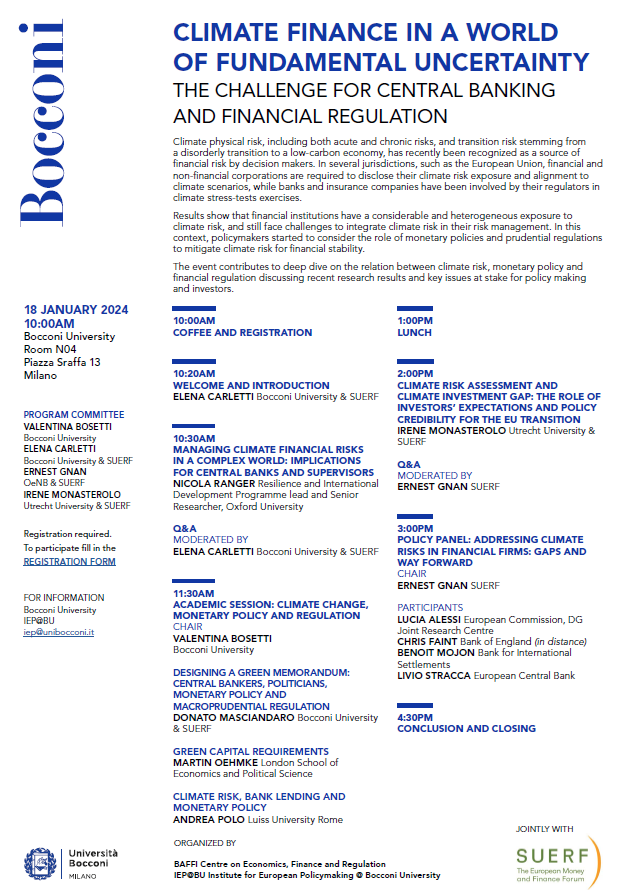

Climate Finance in a World of Fundamental Uncertainty

Climate physical risk, including both acute and chronic risks, and transition risk stemming from a disorderly transition to a low-carbon economy, has recently been recognized as a source of financial risk by decision makers. In several jurisdictions, such as the European Union, financial and non-financial corporations are required to disclose their climate risk exposure and alignment to climate scenarios, while banks and insurance companies have been involved by their regulators in climate stress-tests exercises. Results show that financial institutions have a considerable and heterogeneous exposure to climate risk, and still face challenges to integrate climate risk in their risk management. In this context, policymakers started to consider the role of monetary policies and prudential regulations to mitigate climate risk for financial stability. The event contributes to deep dive on the relation between climate risk, monetary policy and financial regulation discussing recent research results and key issues at stake for policy making and investors.

-

FilePROGRAM-BAFFI-IEP-SUERF-18JANUARY2024_FINAL.pdf (142.43 KB)

-

FileLucia Alessi (462.55 KB)

-

FileDonato Masciandaro (3.15 MB)

-

FileIrene Monasterolo (5.49 MB)

-

FileMartin Oehmke (923.37 KB)

-

FileLivio Stracca (591.65 KB)