European Markets and U.S. Elections: One Year Later

Limited volatility suggests that European markets now view U.S. elections as external political events rather than systemic risks requiring defensive positioning. A commentary by Corrado Botta

As we approach the one-year mark since Donald Trump's 2024 electoral victory, a remarkable pattern has emerged: political headlines have multiplied, but market reactions have been notably muted.

U.S. equities hover near record highs, while European markets have demonstrated strong resilience and even periods of outperformance. The anniversary provides an ideal moment to examine what our research on electoral volatility patterns reveals for European policymakers—particularly as they prepare for the 2026 U.S. midterm elections.

The S&P 500 sits near record highs in August 2025, up approximately 14% year-to-date, driven primarily by Federal Reserve policy expectations and disinflation progress rather than Washington politics. Meanwhile, European equities led through the first half of 2025, with the EURO STOXX 50 reaching new peaks.

The divergence confirms a crucial finding from our analysis of nine presidential elections (1992-2024): European markets have achieved autonomy from U.S. electoral volatility.

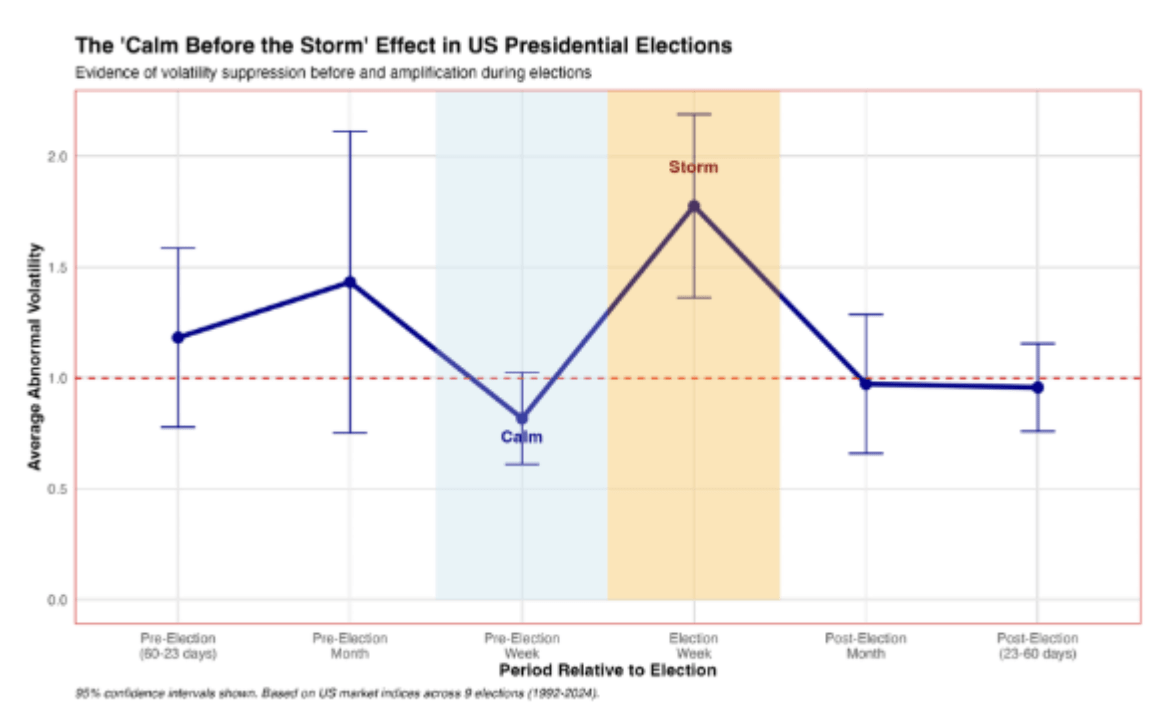

The Persistent "Calm Before the Storm"

Our paper documents a consistent pattern across U.S. elections that we term the "calm before the storm" effect. Market volatility decreases significantly in the weeks immediately preceding elections (−0.63 standard deviations for U.S. indices), followed by a sharp spike during election week (+0.80 standard deviations). This pattern held true in 2024, with the VIX experiencing one of its largest single-day declines immediately after Trump's victory as uncertainty resolved.

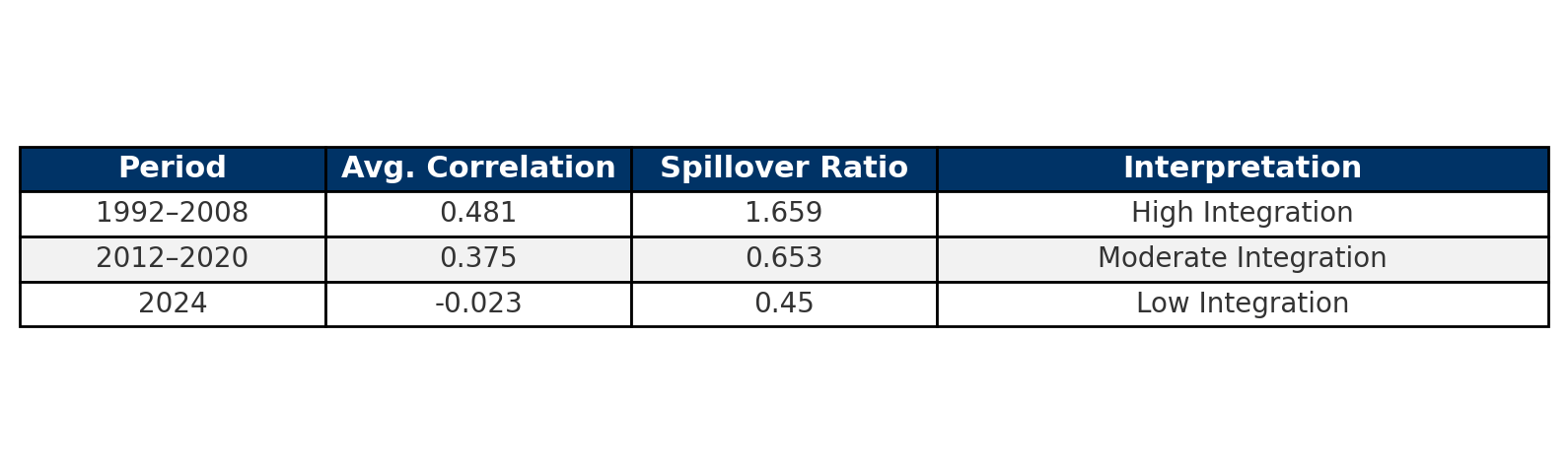

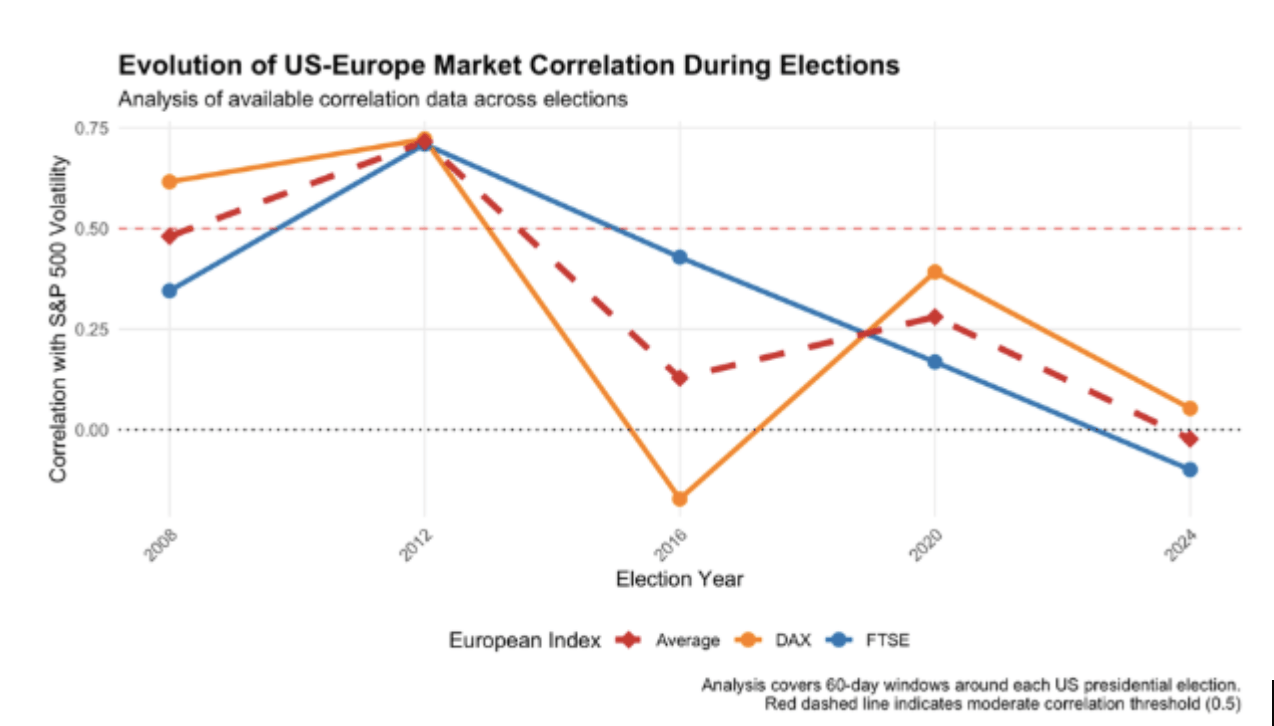

The 2024 election delivered a first in our dataset. The correlation between U.S. and European market volatility during the 60-day election window fell to −0.023, compared to an average of 0.481 during 1992–2008 elections and of 0.280 during 2012–2020 elections.

The observed near-zero correlation represents a decoupling, not merely reduced dependence: European markets marched to their own fundamentals while American markets processed electoral uncertainty.

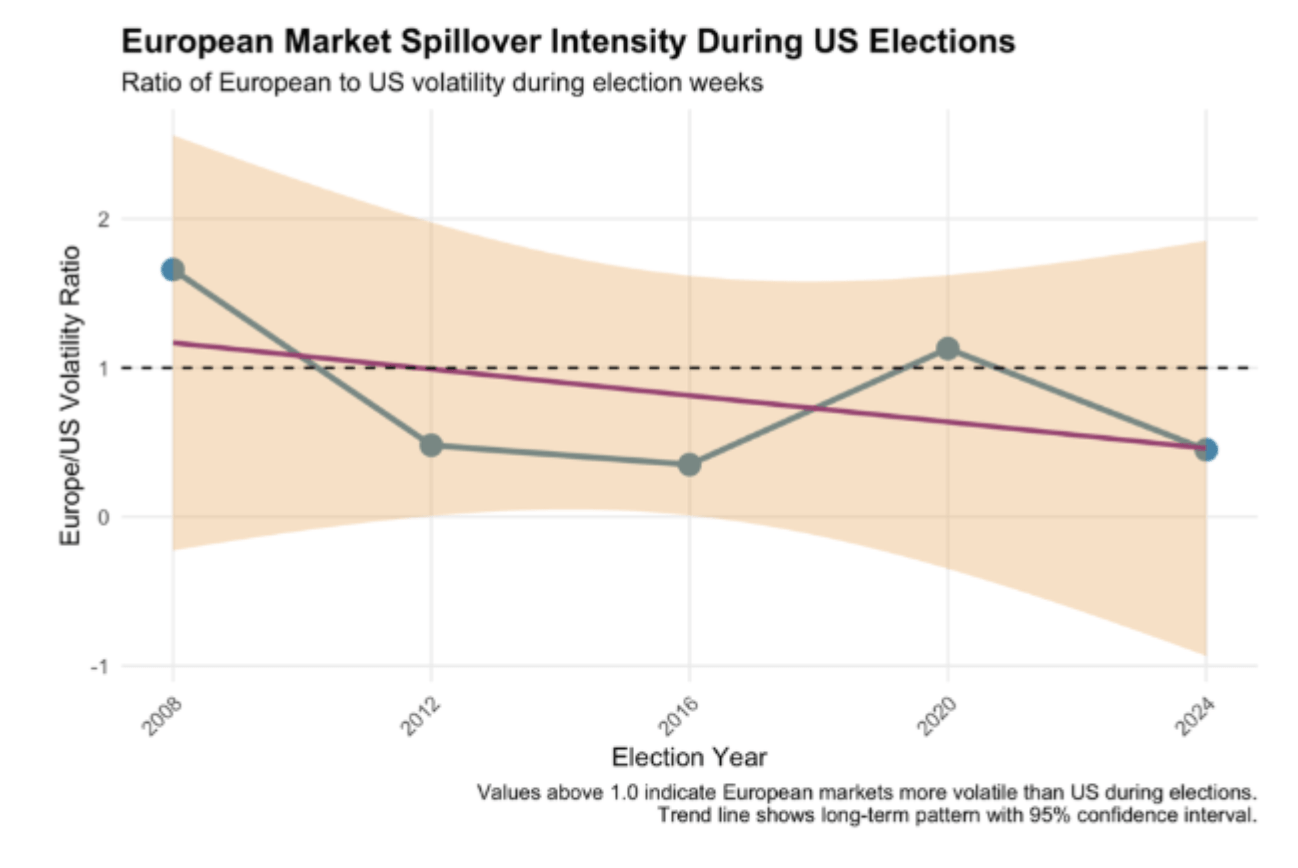

The spillover ratio, measuring how much European volatility responds to U.S. electoral shocks, dropped to just 0.450 in 2024, down from an average of 1.659 during 1992–2008 elections and of 0.653 during 2012-2020 elections.

This suggests that European markets now view U.S. elections as external political events rather than systemic risks requiring defensive positioning.

Why Economic Context Matters More Than Politics

Our paper reveals that economic conditions amplify electoral volatility far more than political factors alone. Elections coinciding with recessions generate volatility approximately 1.79 standard deviations higher than those during normal economic periods.

This finding proved prescient for 2024: despite significant political uncertainty, the absence of recession meant volatility remained contained.

Political polarization, which reached extreme levels in 2024 (scoring 5 on our 5-point scale), increases volatility by 0.48 standard deviations. Yet even this substantial effect pales compared to the economic backdrop multiplier. International tensions, another amplifying factor, added 0.30 standard deviations to volatility in 2024—significant but manageable given stable broader economic conditions.

Interestingly, elections with incumbent participation actually reduce volatility by 0.10 standard deviations, suggesting markets value the certainty of known candidates. The 2024 election, featuring former President Trump as a known quantity despite not being the sitting president, may have benefited from this familiarity effect.

Practical Implications for European Policymakers

For European central banks and financial regulators, these findings translate into specific operational recommendations:

1. Calibrated Response Windows: Establish a 2-3 day heightened monitoring period around U.S. election results, focusing on funding market stress indicators. Our data shows volatility effects concentrate in this narrow window before normalizing rapidly.

2. Conditional Liquidity Provision: Pre-position liquidity facilities but activate them only if quantitative triggers are breached, specifically, sustained widening in cross-currency basis swaps or euro-dollar funding spreads exceeding predetermined thresholds. The 2024 experience suggests these facilities will likely remain unused during economically stable elections.

3. Communication Discipline: Maintain strictly data-dependent guidance during U.S. electoral periods. Avoid reactive messaging to political developments, as our evidence shows European fundamentals increasingly dominate price formation. Pre-draft contingency statements focusing on market functioning rather than political outcomes.

4. Stress Testing Priorities: Incorporate election-recession scenarios into stability assessments. Our findings indicate this combination represents the true tail risk, not elections themselves. Model a doubling of baseline volatility responses when elections coincide with economic downturns.

The 2026 Midterms: A Lighter Touch Required

Our paper encompasses both presidential and midterm elections, revealing important differences.

Midterm elections generate similar directional patterns but with approximately 80% lower magnitude. The election-week volatility spike reaches only 0.16 standard deviations for midterms versus 0.81 for presidential elections.

For the November 2026 midterms, European policymakers should adopt a proportionally lighter framework: maintain monitoring dashboards, ensure communication templates are ready, but expect minimal spillovers absent a concurrent economic shock.

The key insight is that midterms represent "elevated but not exceptional" risk events—they warrant attention but not the full defensive posture appropriate for presidential transitions.

Looking Forward

The structural evolution toward European market autonomy appears irreversible. Deeper European capital markets, enhanced regional integration, and sophisticated local hedging mechanisms have collectively reduced transmission channels from U.S. political events. This resilience represents a significant achievement for European financial architecture.

However, complacency would be misguided. Elections remain capable of generating substantial volatility when combined with economic stress. Policymakers should view the current calm as an opportunity to strengthen frameworks for the inevitable future election that coincides with economic turbulence.

The 2024 election's market dynamics, with initial volatility suppression, sharp resolution, and rapid normalization, validate our multi-decade findings while highlighting European markets' newfound resilience. For policymakers, the message is clear: prepare for U.S. electoral spillovers, but trust in European market depth to absorb political shocks that once threatened stability.

IEP@BU does not express opinions of its own. The opinions expressed in this publication are those of the authors. Any errors or omissions are the responsibility of the authors.