Europe’s Internal Tariffs: Why the IMF’s 44% Estimate Doesn’t Hold Up

The IMF’s estimate—suggesting internal EU trade barriers amount to a 44% tariff— cited even by Mario Draghi in an Ft article lacks solid analytical foundations. A commentary by Lorenzo Bini Smaghi

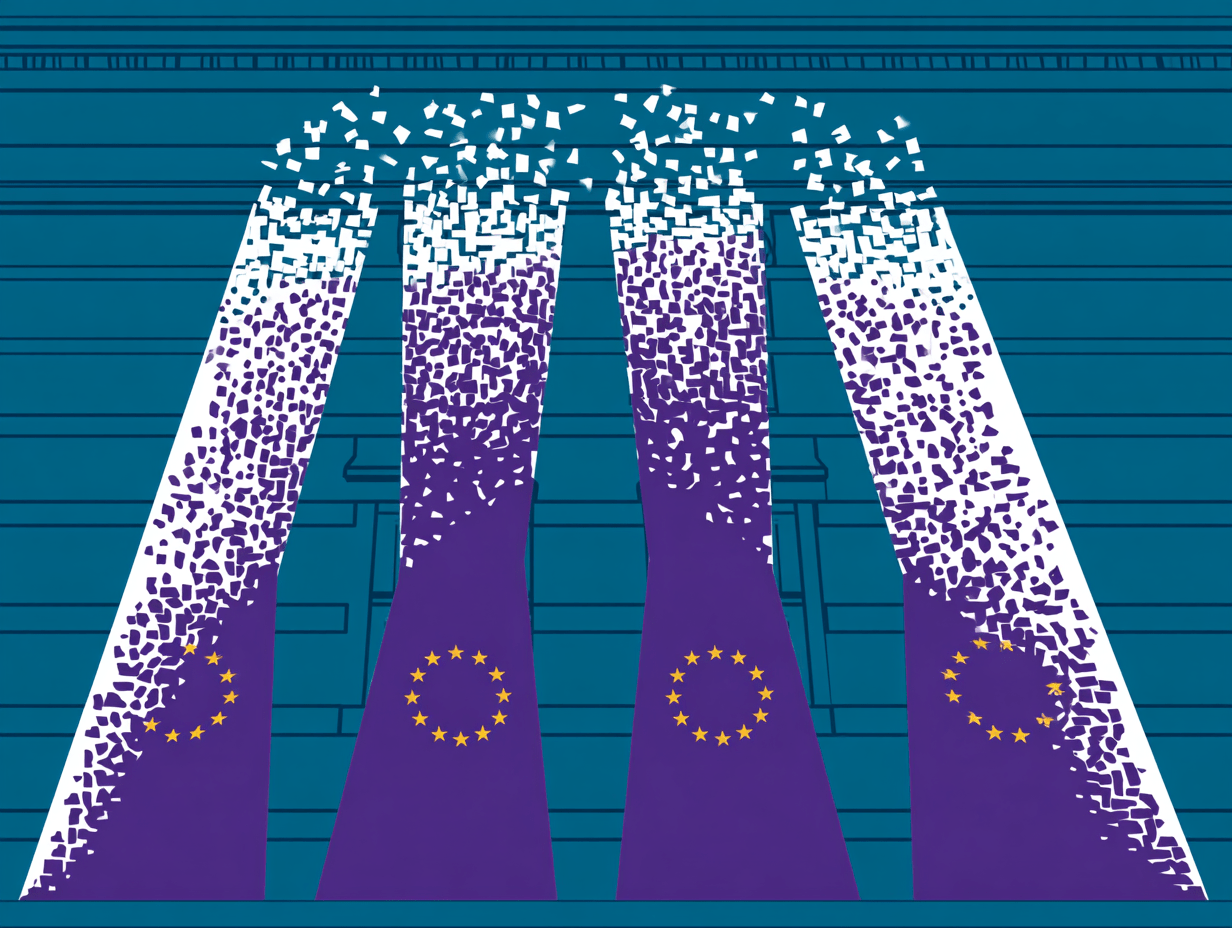

European debates over how to deal with Trump’s tariff threats often end up mentioning the spectre of internal trade barriers. Why worry about American protectionism, the argument goes, when European Union member states impose the equivalent of a 44% tariff on trade within their own single market—far higher than the 15% within the United States?

It’s a compelling line, repeated by prominent policymakers and economists. But it rests on sand.

The 44% figure first appeared in an IMF report on the European economy released in October 2024, with no further references. It got some publicity in a widely read Financial Times article by Mario Draghi, titled “Forget the US – Europe has successfully put tariffs on itself,” published on February 14, the day when the IMF released the working paper (No. 25/40) that supposedly underpins the claim.

Yet the document offers little clarity. No dataset is disclosed. No robustness checks are presented. Still, the assertion that “internal EU barriers are equivalent to a 44% tariff” has gained the status of revealed truth—repeated so often that it is hardly questioned.

But it should. The 44% figure contradicts the broader academic literature. In a 2021 article in the Journal of Economic Perspectives, economists Keith Head and Thierry Mayer wrote that although “In terms of formal institutions, the European Union is not on the verge of becoming a “United States of Europe”… on multiple fronts, EU economic integration now matches or even beats the equivalent measure for the 50 American states. This is remarkable. The United States has more than 230 years as a federal state with a constitutional prohibition on barriers to interstate commerce. The border tax equivalents implied by flows of goods and merger and acquisition transactions within the EU15 have reached the levels estimated for US states. When measuring integration as convergence in price levels, the EU15 is quite similar to the American states.”

So how did the IMF arrive at a conclusion that seems so far removed?

To begin with, the February IMF paper offers no transparency about its data sources, assumptions, or estimation techniques. All that’s shared are headline numbers: an average bilateral trade barrier of 44% across the 28 European countries (UK included), and sector-specific figures ranging from 10% in chemicals to more than 140% in agriculture.

One obvious issue is that the IMF does not distinguish between long-standing EU members and newer entrants. Yet it takes time for market access to translate into frictionless trade. For countries like Poland, Romania, or Croatia, trade frictions are expected to remain higher compared to the previous members.

The IMF’s own authors acknowledge this point—yet they proceed to emphasize the EU-wide average, which is therefore biased and meaningless.

A more fundamental problem lies in the paper’s treatment of trade preferences in the estimation methodology. Differences in bilateral trade flows between EU countries are considered as trade frictions, even when they result from consumer preferences—home bias—rather than regulatory barriers.

Consider wine consumption. Italian wine is drunk comparatively more in Italy, and French wine in France. As a result, the bilateral wine trade between the two countries is modest relative to total consumption.

But the IMF model treats this pattern (which is perfectly rational from an oenological viewpoint) as equivalent to a trade barrier. It’s thus not surprising that the tariff-equivalent barrier in the food sector is estimated at 70%. In textiles, the implied intra-EU tariff is a staggering 120%.

This assumption ignores the fact that, unlike American consumers, Europeans often exhibit strong cultural, environmental, and climatic preferences for local products—especially in food and other identity-laden goods, including fashion. The preference for the local is not necessarily the product of protectionism; sometimes, it’s just taste.

The IMF authors themselves acknowledge that their estimate should be considered as the upper bound of a plausible range. But they do not disclose what the lower bound might be—or how wide the confidence interval is.

The real issue here is not the working paper itself, which, like any empirical exercise, should be taken with caution and subjected to peer scrutiny. The problem lies in the elevation of the 44% number into a policy mantra. The seductive precision of that figure has distracted from a more nuanced and accurate reading of the data.

Ironically, the broader message of the IMF’s research paper points in a different direction. Accordingly, the real obstacle to the European internal market lies not in hidden tariffs but in domestic restrictions that hamper the growth of companies, and thus their ability to compete cross-border.

That’s the message European policymakers should be focusing on. And act upon.

A first version of this article was published in the Italian daily Il Foglio

IEP@BU does not express opinions of its own. The opinions expressed in this publication are those of the authors. Any errors or omissions are the responsibility of the authors.