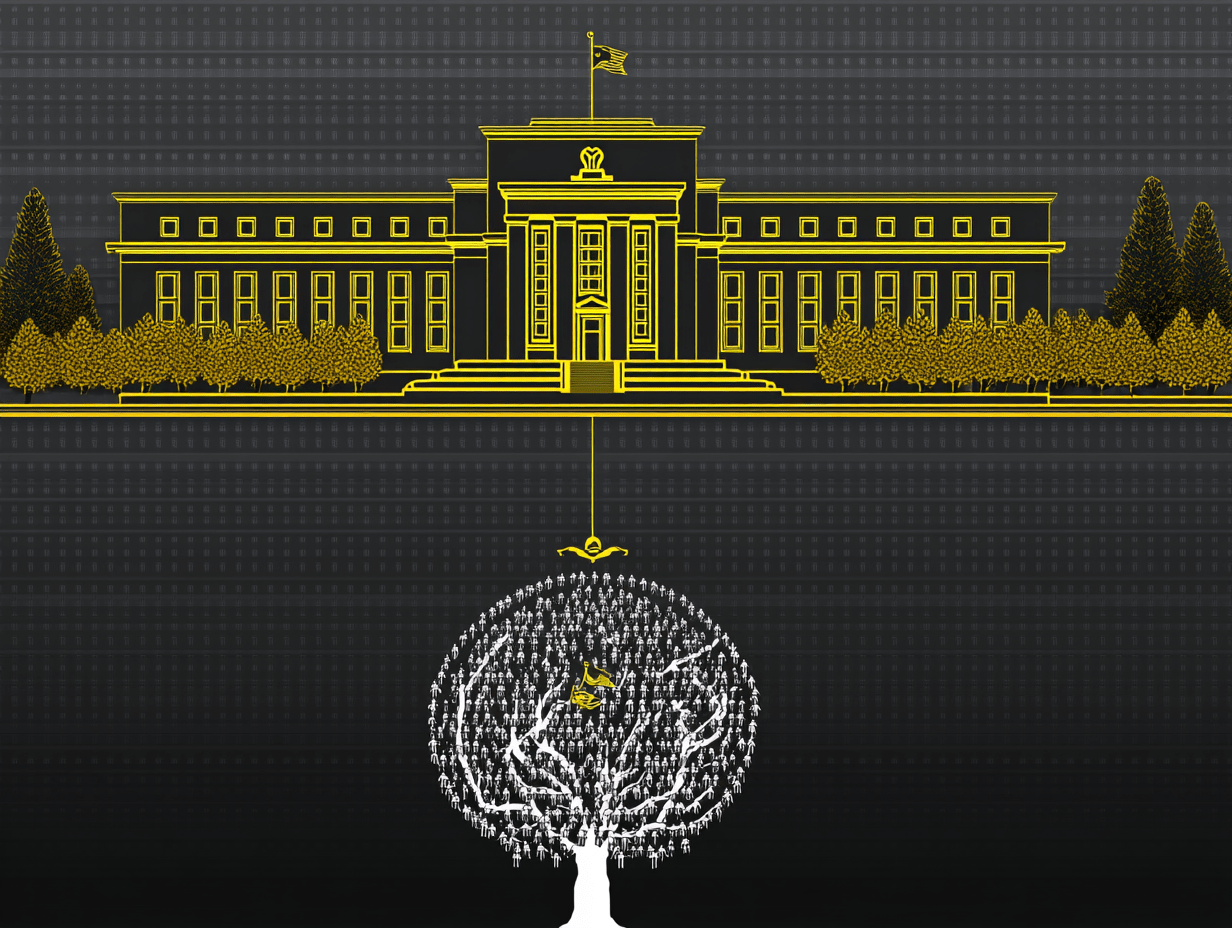

The Federal Reserve Is Not as Stupid as Trump Claims

The US President attacks a central bank that is merely applying the lessons of the post-Covid era. A commentary by Lorenzo Bini Smaghi

The US central bank decided this week not to cut interest rates, and Donald Trump immediately accused it in public of being “stupid.”

The Federal Reserve can indeed seem foolish—if one assumes that lower rates are always beneficial, at least in the short term, and ignores the medium-term costs. Costs that would ultimately be borne by US citizens, especially if inflation were to pick up again.

This already happened after Covid, as Trump himself should recall, having won the presidency thanks to the public’s discontent with the rising cost of living in recent years. That same discontent now threatens to unseat those currently in power. But this does not seem to concern Trump, since he will not be running in the next election, three years from now.

In reality, the US central bank is simply learning the lessons of the inflationary experience of 2021-22, when it was slow to tighten policy in response to an inflationary shock that seemed temporary, but turned out to be more persistent and difficult to tame.

Today’s situation is, in some respects, different—but there are some important similarities.

In both cases, the triggering factor is an external shock.

The post-Covid surge in inflation was driven by rising energy prices in connection with the outbreak of war in Ukraine. The current price pressures stem from tariffs on imported goods.

In theory, such shocks produce only temporary effects. The erosion of purchasing power caused by a one-off increase in import prices tends to depress consumption and activity.

The resulting economic slowdown typically leads, within a short time, to downward pressure on prices, with inflation gradually returning to its previous level. In these circumstances, the central bank should not overreact, since the rise in inflation is temporary and tends to self-correct.

After Covid, however, things played out differently. The inflationary spike of 2021-22 was much larger and more persistent than expected.

Three years on, US inflation remains above target—for at least three reasons that were underestimated at the time.

First, the external shock occurred while the economy was growing strongly and operating at full employment, so the adjustment following the initial price surge was slower than expected.

Second, the Biden administration’s fiscal policy remained highly expansionary, even after the pandemic ended, amplifying the initial inflationary impact.

Third, monetary conditions stayed loose for too long, with nominal interest rates below inflation—effectively pouring fuel on the inflationary fire.

This was, clearly, a miscalculation by the central bank, which underestimated the combined impact of these factors. It is a mistake the Fed does not want to repeat.

Especially since the US economy continues to see unemployment near historic lows, despite the recent slowdown. Furthermore, the budget bill that Congress is about to pass (“The Big Beautiful Bill”) includes tax cuts that will provide further stimulus to the economy.

Finally, unlike the previous period, the dollar is now falling sharply, which may further increase the price of imported goods.

In this scenario, a premature rate cut risks keeping inflation to remain high and entrenched, and long-term interest rates to rise, which would further exacerbate the burden of public debt—which is now higher than Italy’s, as a share of GDP (4.6% versus 3.9% at the end of 2024).

Looking ahead, the greater risk is a loss of credibility for the US central bank, which would undermine the dollar and the stability of the financial system. The Fed is doing everything it can to avoid such an outcome. In this context, the public attacks from the White House certainly do not help.

From a European perspective, the only consolation is that the European Central Bank now enjoys broad consensus and appears much better protected from reckless political attacks.

This is one reason why it managed to lower interest rates in recent months.

A first version of this article was published in the Italian daily Il Foglio

IEP@BU does not express opinions of its own. The opinions expressed in this publication are those of the authors. Any errors or omissions are the responsibility of the authors.