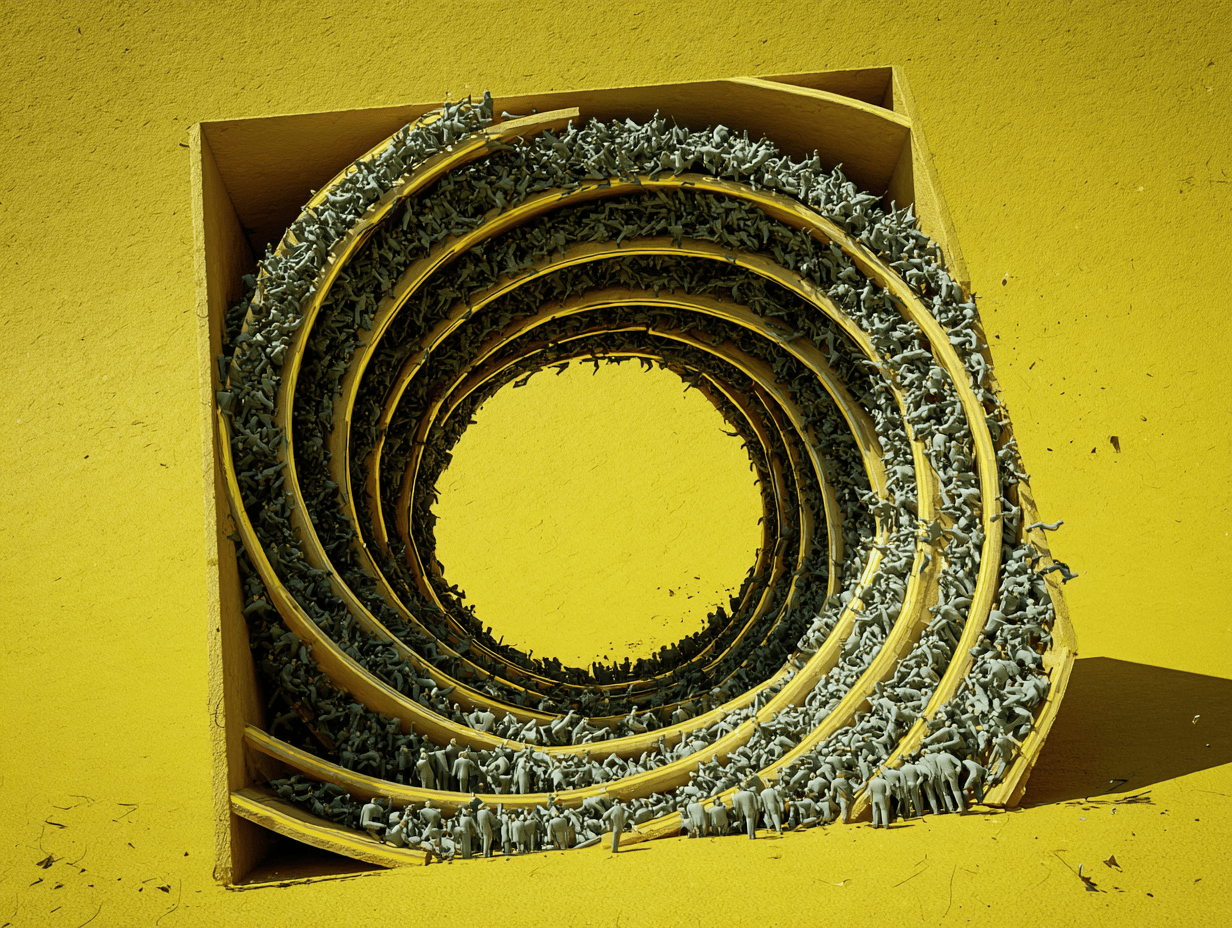

France Shows How the Populist Spiral is Tightening in Western Democracies

French politics highlights the vicious cycle of cuts, disillusionment, and populist advance. A commentary by Catherine E. De Vries

France has become the canary in the coal mine of the populist spiral: the drive for cuts topples governments, distrust deepens, populists advance, and markets take fright. François Bayrou’s resignation, after losing a confidence vote on his deficit-cutting package, was not merely another Parisian power struggle. It was a stark warning of how fiscal strain, the erosion of public and social services, and growing distrust are combining to tighten the populist spiral across Western democracies.

Put simply, the spiral looks like this. High public debt forces governments into fiscal consolidation. Cuts erode public and social services. Citizens experience the decline, lose trust in politics, and grow resentful. Populist parties surge, promising radical change. They channel discontent into simple narratives: blaming corrupt elites for neglect and migrants for straining already diminished services. Their advance unsettles financial markets, which push up borrowing costs. Rising debt-servicing pressures then narrow budgets further, creating the need for still more cuts. And we are back to square one.

Across the OECD, fiscal deficits averaged 4.6 per cent of GDP last year, up from 2.9 per cent before the pandemic. Interest payments alone now consume over 3 per cent of GDP, almost as much as NATO members plan to spend on defence by 2035. Bondholders are restless, fiscal experts urge governments to tighten their belts as ageing populations and geopolitical tensions drive up spending demands, but electorates are increasingly unwilling to accept more restraint. France is not an outlier but a bellwether: the political fallout in Paris today may well be echoed in London, Rome, or even Washington tomorrow.

France is firmly caught in the populist spiral. Bayrou’s deficit-cutting plan, meant to calm markets, alienated parliament and ultimately cost him his job. Meanwhile, Marine Le Pen’s Rassemblement National is surging, its narrative of betrayal and renewal resonating more than Macron’s dry appeals to fiscal discipline. Investors, far from reassured, see a crumbling political centre, and French 10-year borrowing costs at their highest since 2009.

The pattern is not uniquely French. My research shows that in Italy, populist parties gained most ground where local services were cut deepest, and in Britain, constituencies that saw NHS provision retreat swung sharply towards Nigel Farage’s Reform UK. Cross-national studies by fellow political scientists confirm the broader trend: since the 1980s, fiscal cuts and populist breakthroughs have repeatedly coincided. What drives voters, my studies suggest, is not abstract numbers but tangible experiences: the closed clinic, the thinly stretched police, the fraying school.

What makes the populist spiral more perilous today is the global backdrop. After the 2007–09 financial crisis, governments could delay consolidation by borrowing cheaply, a situation made possible by central banks’ massive programmes of quantitative easing. That cushion has vanished. UK 30-year gilt yields touched 5.75 per cent this summer, their highest since 1998. US long bonds hover near 5 per cent. The long-dormant Japanese market has stirred.

Investors are not throwing tantrums; they are repricing sovereign risk. With record levels of debt and weaker demand from traditional buyers, governments must now pay far more to borrow. The danger is that political uncertainty amplifies this repricing. As populist parties advance, markets grow warier of governments’ ability to sustain fiscal discipline. The result is higher risk premia, steeper borrowing costs, and tighter budgets, all of which feed back into the populist spiral.

Governments in much of the West are caught in a bind. Ageing societies demand more spending on pensions and healthcare. Geopolitical tensions push defence budgets higher. Yet voters, disillusioned by years of declining public services, show little appetite for higher taxes.

Markets, meanwhile, are charging more for every pound or euro of borrowing. The response so far is troubling.

In London, the Starmer government has turned to spending restraint. In Berlin, defence budgets are rising even as healthcare and social support lag. The danger, especially in Europe, is that the continent repeats the mistakes of the past: hollowing out public services and fuelling the very populism that markets fear.

Bond yields are not just financial data. They are a measure of political fragility. As borrowing costs climb, they expose markets’ doubts about whether governments can stabilise debt without corroding legitimacy.

France’s turmoil shows how quickly the populist spiral can accelerate once cuts collide with voter discontent and deepen distrust. Bayrou’s fall is thus more than a French story. It is a warning to any government that believes it can cut its way back to credibility. Unless leaders protect the services citizens rely on while restoring fiscal balance, they risk being dragged ever deeper into the spiral.

Breaking out of the spiral will require more than restraint. Western democracies need to rekindle growth by investing in innovation, higher education, and the skills base, while also attracting top talent from abroad. But governments seem to be doing the exact opposite.

Only by expanding opportunity can governments meet fiscal pressures without hollowing out public services. Otherwise, the politics of resentment will tighten its grip, and the ballot box will punish those who ignore the everyday realities of hospitals, police stations, and schools, and the distrust their neglect breeds.

IEP@BU does not express opinions of its own. The opinions expressed in this publication are those of the authors. Any errors or omissions are the responsibility of the authors.