How to Interpret Sovereign Bond Market Reaction to France Snap Elections

The European Sovereign Bond market gyrations erupted in the wake of President Emmanuel Macron’s call for a snap parliamentary vote after his party’s defeat to Marine Le Pen’s National Rally in the European elections have sparked a debate on the opportunity of an activation of the Transmission Protection Mechanism (TPI).

The European Sovereign Bond market gyrations erupted in the wake of President Emmanuel Macron’s call for a snap parliamentary vote after his party’s defeat to Marine Le Pen’s National Rally in the European elections has sparked a debate on the opportunity of activation of the Transmission Protection Mechanism (TPI).

The TPI is an addition to the ECB toolkit that can be activated to counter unwarranted, disorderly market dynamics that seriously threaten the transmission of monetary policy across the euro area.

The TPI gives to the Eurosystem the ability, subject to fulfilling established criteria, to make secondary market purchases of securities issued in jurisdictions experiencing a deterioration in financing conditions not warranted by country-specific fundamentals, to counter risks to the transmission mechanism to the extent necessary.

There are two relevant issues in this debate.

The first one is if what we see in the market is a repricing of bonds justified by a modified scenario for future fiscal fundamentals or disorderly market dynamics not justified by the evolution of future fiscal fundamentals

The second one is the specification of a list of criteria to assess whether the jurisdictions in which the Eurosystem may conduct purchases under the TPI pursue sound and sustainable fiscal and macroeconomic policies, therefore fulfilling the established criteria.

On the first issue the pricing mechanism of perpetual loans hypothetically granted to Member States by a European Debt Agency (EDA) according to their credit class is helpful to determine a dynamic yield corridor that captures idiosyncratic risk and filters liquidity risk.

To price the irredeemable mortgage scheme the EDA would compute the present value of an infinite stream of payments using as a discount rate the yield that reflects its cost of debt, which is proxied by the euro area 10-year fixed interest rate on swaps.

Future payments are not deterministic, but they occur only if MSs are not in “default". The probability with which a given MS enters the state of default in each future period is computed by assigning each MS to a specific credit risk class based on its creditworthiness ( we consider eight credit risk classes: AAA, AA, A, BBB, BB, B, CCC D), from the safest (conventionally labeled AAA) to the default class (labeled D), assuming that a country defaults only when it reaches state D, and modeling the transition from one state to the other via a transition matrix estimated averaging publicly available data of rating grades assigned to sovereign debts by Credit Rating Agencies in the period 1993-2015 (Standard & Poor's Sovereigns Ratings have been downloaded from Bloomberg).

The interest rate on the perpetual annuity is the benchmark that we offer to evaluate fluctuations in the yields of 10-year government bonds. As this varies with creditworthiness, we report for each country's bounds represented by the interest rates of the classes just above and just below in terms of creditworthiness. Violations of bounds can be used to discriminate between “repricing” and “disorderly market dynamics”.

Bounds for 10-year sovereign bonds of all Member states are made available by IEP@BU at the website.

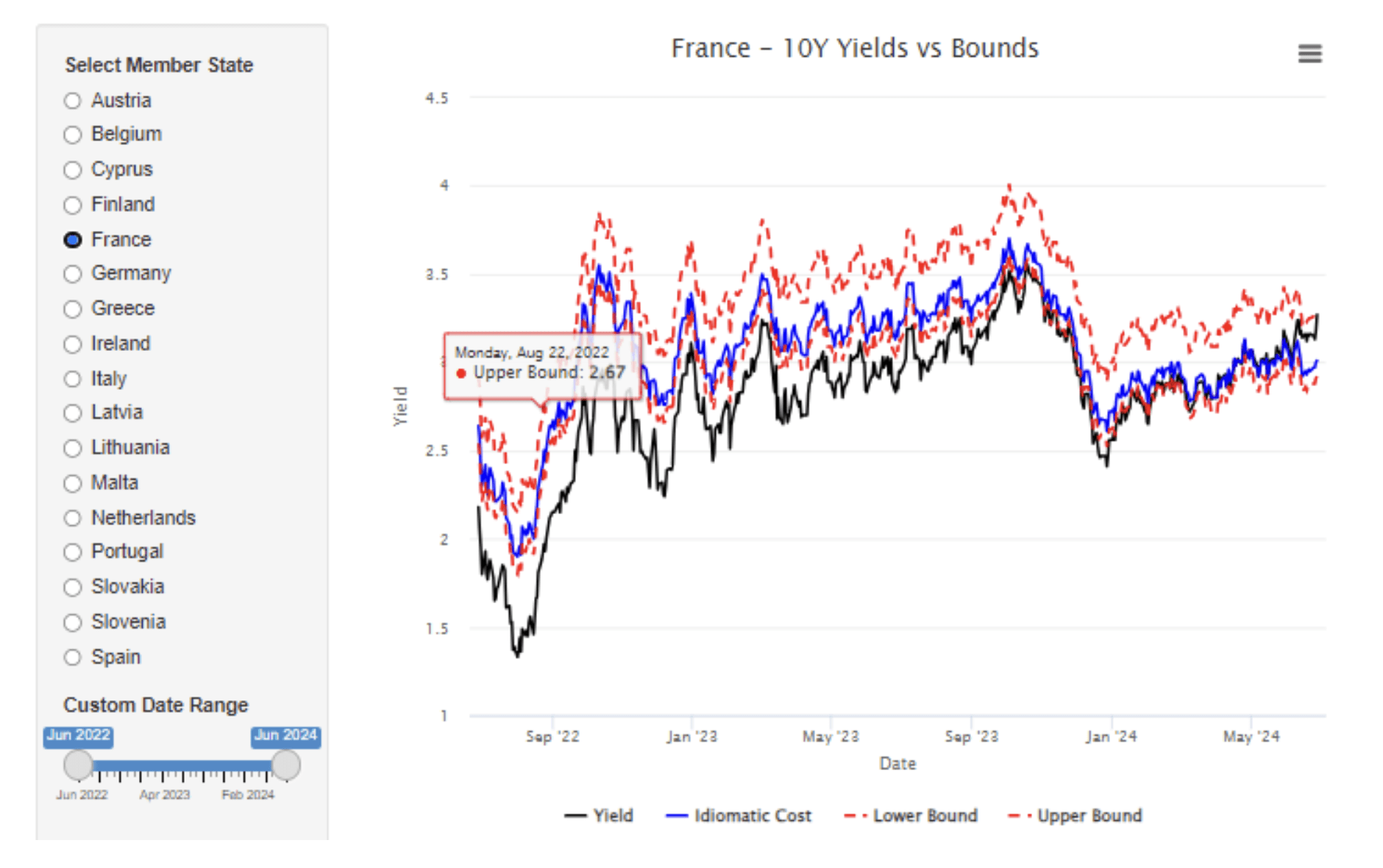

We report herewith the case for France ( current in the S&P AA- class and therefore AA for our classification).

The Figure illustrates that the recent gyrations have taken the 10-year OAT yield slightly above the idiomatic cost, i.e. the rate of interest on a fairly priced annuity, but the upper bound has never been violated although it has been reached twice, immediately after the announcement of snap elections, and Friday, June 29th the last day in which the market was opened before the French elections of June 30th, 2024.

The evidence of France is consistent with that from all other countries as no violations of the bounds has been observed (this claim can be checked by ticking the country of interest on the website).

It is noteworthy that the major violations of the bounds are observed in the case of the German Bund, whose price regularly fluctuates below the idiomatic costs: in the absence of a European Safe asset market participants concentrate on the Bund when they “fly to quality” and the recent episode of increases Ota-Bund spread occur because as the OAT yield is going up the BUND yield is going down.

Overall, our proposed benchmark speaks in favor of “repricing” rather than “disorderly market dynamics”, as French government bond prices have not so far substantially deviated from those implicit in the evaluation of the rating agencies, however, some market dynamics not fully consistent with fundamentals is observable as a consequence of the absence of a truly European Safe Asset.

The evidence of France is consistent with that from all other countries as no violations of the bounds has been observed (this claim can be checked by ticking the country of interest on the website)

If you are interested in the European Parliament activity, please check a new tool that the IEP@BU has just launched, with professors Simon Hix and Abdel Noury: the EPVM - European Parliament Vote Monitor

IEP@BU does not express opinions of its own. The opinions expressed in this publication are those of the authors. Any errors or omissions are the responsibility of the authors.