Interest Rate Cuts? If You Don’t Know What You Are Doing, Do it Gently

The Fed and the ECB conducted monetary policy reviews in 2019-2020, when most of the above shocks were still in the making or yet to come. Both of them seem largely obsolete today, or at least incomplete. There is no appetite to restart them.

Economists like to borrow an expression from Winston Churchill (“Never let a good crisis go wasted”) to mean that economic and financial crises teach lessons that should not be ignored.

The last 15 years offer an illustration of not just one crisis, but of a sequence of them: near financial collapse followed by recession; massive prolonged monetary expansion; global pandemic with millions of deaths, lockdowns, and another recession; an inflation shock never seen in the preceding half-century; the end, hopefully, last but not least, war in Europe and in the Middle East.

There would be enough to induce policymakers, central bankers particularly, to rethink their concepts and practices preparing them for a radically different and unpredictable global environment.

Nothing of this is happening. The Fed and the ECB conducted monetary policy reviews in 2019-2020, when most of the above shocks were still in the making or yet to come. Both of them seem largely obsolete today, or at least incomplete. There is no appetite to restart them.

The review prepared by Ben Bernanke for the Bank of England is limited to forecasting techniques and communication; too narrow to address what Martin Wolf, the Dean of Financial Times economic commentators, called “the Great Inflation Disaster”.

Academic research takes time and tends to lag behind; the impression, confirmed by Google searches, is that monetary research output peaked in the late 1990s, at the time of the “Great Moderation”, and declined thereafter. The economic “perma” crisis – to borrow the expression used by Gordon Brown, Mohammed El Erian, and Michael Spence in a recent book – is at risk of going wasted.

The monetary debate now seems hijacked by one simple down-to-earth question: when will central banks reduce interest rates, how fast and by how much? The pressure on them is significant. Financial institutions profit especially when interest rates decline and credit conditions are loose. Their wish meets that of indebted governments on this side of the Atlantic, whose politicians are often vocal on ECB policy.

The press picks up and conveys: arguments and analyses from investment bank newsletters inform the questions addressed to the ECB President in her regular press conferences.

Short of addressing the big theme – what monetary policy is apt for a radically changed world – the simpler point made here is that the down-to-earth question is not disjoint from the broader one. And that lacking proper answers to the latter, the right approach to the former should be dictated by prudence.

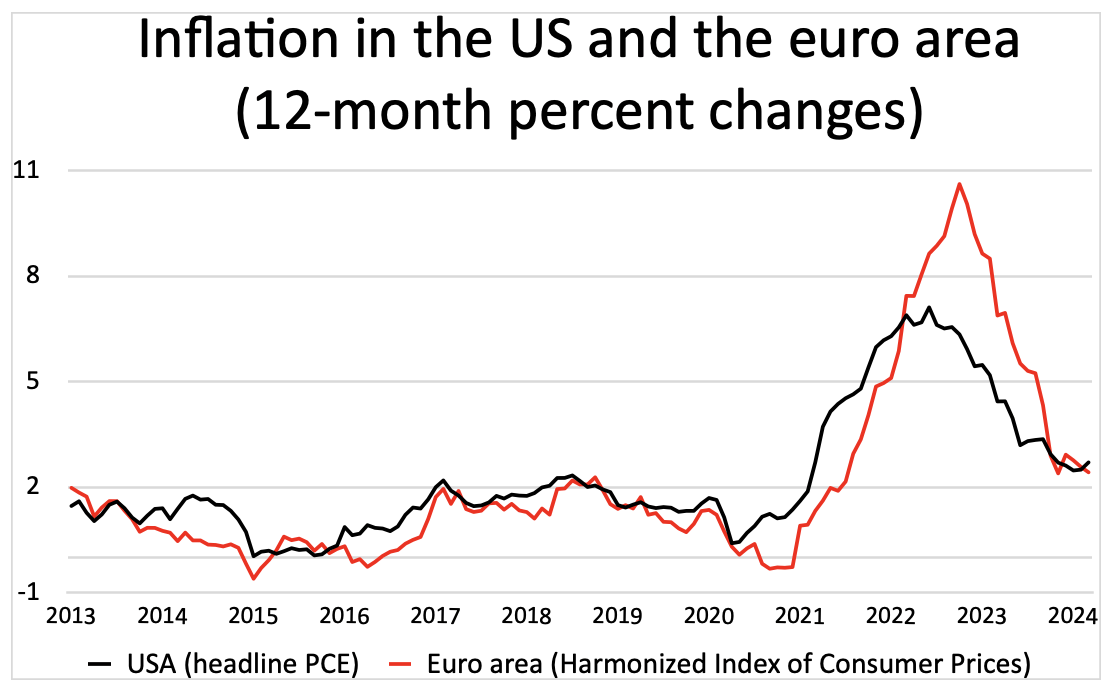

The recent experiences of the US and the euro area highlight noticeable differences. Inflation performance was strikingly similar in the years preceding Covid-19, yet the respective monetary policies diverged sharply.

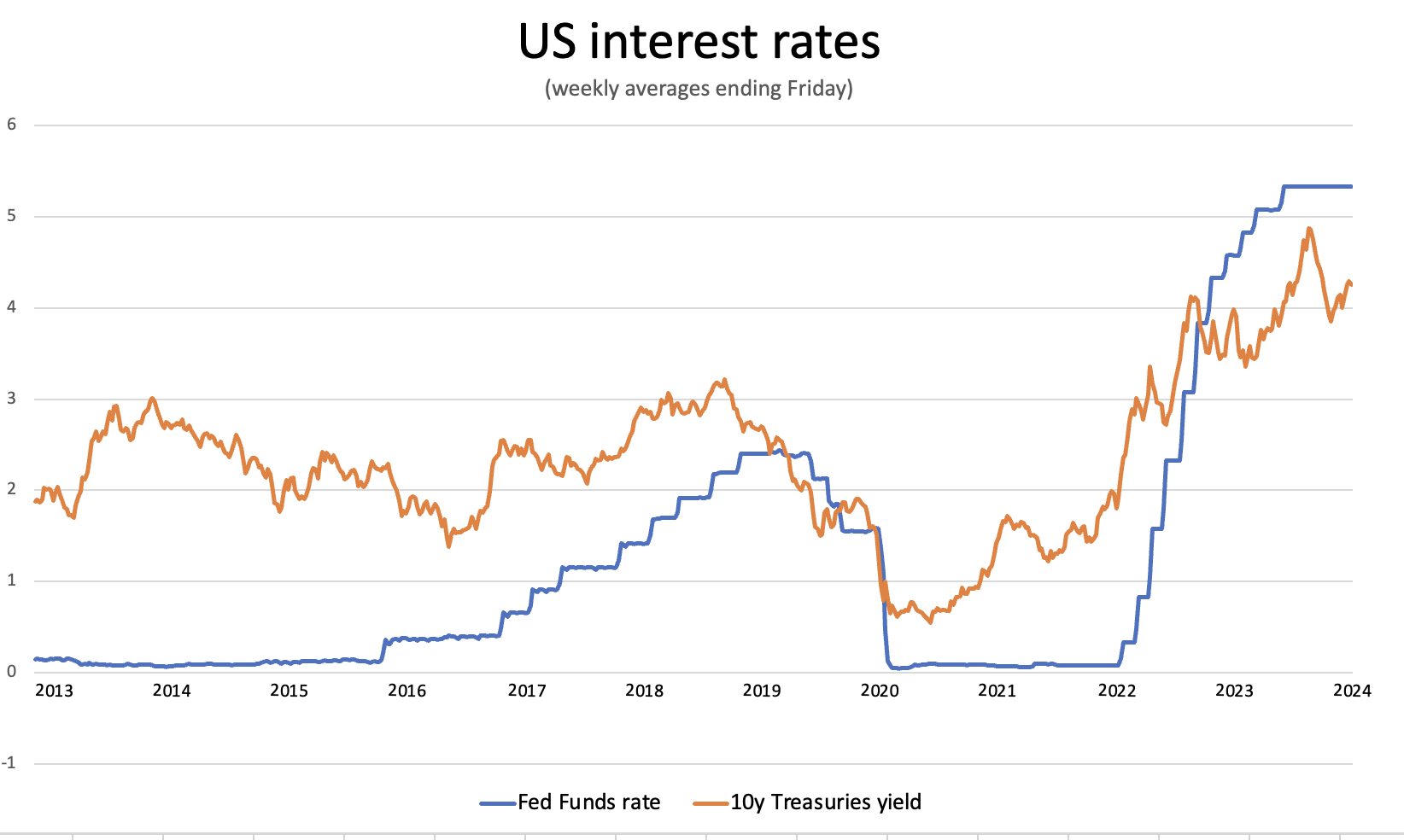

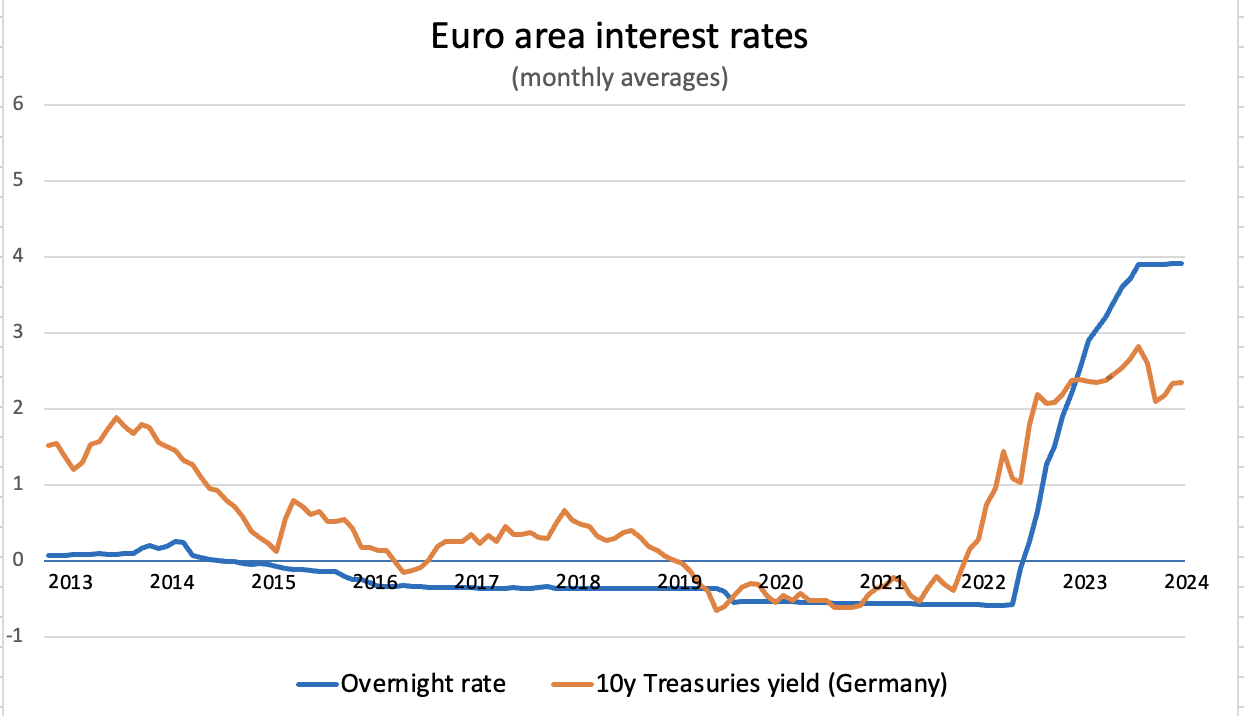

The Fed raised its target (federal funds) interest rate decisively between 2015 and 2019, while the ECB brought its rate in negative territory and kept it there. When Covid hit, the Fed had more “room for maneuver” on interest rates: the ECB’s response relied mainly on QE (a new pandemic facility, called PEPP).

Both the Fed and the ECB delayed their response to the rise in inflation by about a year – roughly, the former between March 2021 and March 2022, the latter between August 2021 and July 2022.

Inflation started rising earlier in the US; in the euro area, it peaked later, at a higher level. In both cases, the delayed responses led to sudden and steep rate increases thereafter, but at quite different levels: the Fed from zero to 5.25%, the ECB from minus 0.5% to 4.0%. All this while the respective inflation rates, measured by the respective “headline” indices, are now roughly the same.

Rather fundamental questions arise from these experiences on the consequences of prolonged monetary expansions and sharp monetary policy overturns on both price and financial stability.

Simple-minded monetarist theories are largely discredited today, but it is impossible to look at the last 15 years without asking oneself whether the prolonged phase of QE, absent proper exit strategies, caused or at least permitted the rise of global inflation in the early 2020s. The question extends to financial stability: in the US, the unprecedented sequence of hasty expansion and restriction in 2020-2022, with ensuing massive shifts in bank balance sheets, is a prime co-suspect behind the Spring 2023 banking turmoil, which led to bank failures and sent shock-waves to the global financial sector1.

Monetary policy and financial stability, traditionally separate within central banks with limited interaction and cross-checks between them, may be more related than we thought.

What lessons should be drawn from all this on how to articulate and quantify central bank targets; how to identify different sources of shocks and react to them; on the merits and dangers of negative rates; on the right degree of interest rate gradualism and pre-commitment; most fundamentally, on the interest rate level central banks should aim at on average over the cycle?

Central banks are poised to make important decisions as early as mid-year, well before those questions are spelled out let alone answered. This suggests caution.

The current mild anti-inflation stance is working. Inflation is declining but is not yet conquered. If there is one lesson already we have learned from the recent past is this: don’t take the future for granted. Short-term interest rates are somewhat higher in the US, lower, and close to long historical records in the eurozone. While the Fed seems inclined to wait, recent statements from the ECB suggest a rate cut is coming. Is there space for it? Little, at best. Barring bad surprises ahead, a minor move – say, a quarter percent point – may fit in; but not the sequence of cuts markets have recently been expecting.

“If you don’t know what you are doing, do it gently”; so an old and wise motto goes.

1 A forthcoming report by a joint US-European team examines these issues in some detail; see I. Angeloni, S. Claessens, A. Seru, S. Steffen, B. Weder di Mauro: Much Money, Little Capital, Few Reforms: The 2023 Banking Turmoil; 2024 Geneva Report, forthcoming.

Inflation is declining but is not yet conquered. If there is one lesson already we have learned from the recent past is this: don’t take the future for granted

IEP@BU does not express opinions of its own. The opinions expressed in this publication are those of the authors. Any errors or omissions are the responsibility of the authors.