Policy Brief n.27 - The Elusive Cost of Trade Disruption

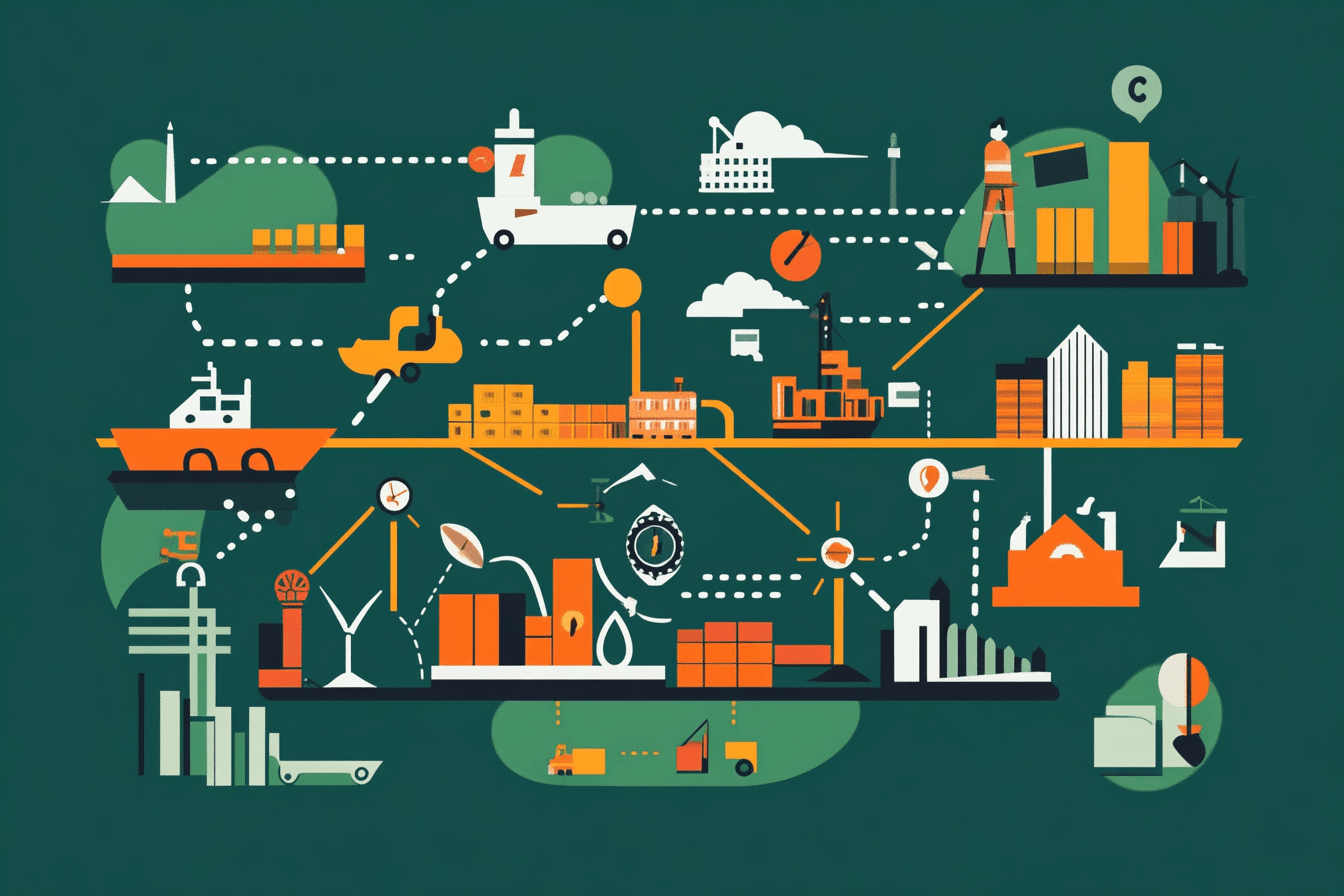

Robust port infrastructure can significantly mitigate the risk of supply chain disruption, suggesting that government efforts are better targeted at improving the performance of ports and critical infrastructure more broadly, rather than implementing protectionist measures.

-

File

Executive Summary

In the last 30 years, global production and international trade have become much more interconnected and interdependent. The recent events in the Red Sea for instance, have highlighted the hazards posed by extended interruptions at critical locations. International institutions concur with growing apprehensions over the escalation of geopolitical threats that could culminate in prolonged conflicts and political fragmentation.

The lack of dependable trade agreements, the unpredictable operation of commercial hubs, and the obligatory redirection of routes can have a greater impact as the degree of economic integration increases. Similar concerns have been expressed in other domains.

One is Europe’s dependency on imported critical raw materials for the production of batteries, while another is the reliance on a handful of foreign countries that dominate the production of semiconductors.

These concerns have spurred energetic reactions by the European Commission, which has launched a series of initiatives aimed at fostering the EU’s “strategic autonomy”. Examples include the “Chips Act” and the “Critical Raw Materials Act”, both aimed at making the EU more self-reliant in key strategic areas.

More broadly, the policy action of the Commission is increasingly driven by the narrative according to which the EU must be less dependent on foreign countries.

The problem with this narrative is that it has been developed almost in an empirical vacuum.

Quantifying the potential cost of trade disruption is thus crucial, as it allows to put in perspective the risks associated with implementing dangerous inward-looking policies, which might undo decades of market integration and productivity-enhancing trade agreements.

This policy brief presents a case study based on daily records of imports and exports in maritime commerce in a sample of Chinese ports exposed to severe natural calamities. Our approach leverages recent advances in satellite data collection technology, thus constituting an example of how big data can help formulate evidence-based policy.

IEP@BU does not express opinions of its own. The opinions expressed in this publication are those of the authors. Any errors or omissions are the responsibility of the authors.