Bank Profitability in Uncertain Times

While banks are now profiting from the new interest rate scenario, the ultimate long-term effect of heightened interest rates on bank performance remains uncertain.

The higher interest environment, influenced by developments in inflation and monetary policy, has positively impacted the profitability of the European Union (EU) banking sector, with an average Return on Equity (RoE) in March 2023 of 10.4% (10.9% for Italian banks).

This achievement comes after over a decade of successive crises (the global financial crisis and the euro sovereign debt crisis), tightened regulation, a monetary policy measures with a low-for-too-long-interest rate environment, and Covid-related policy actions that banned banks from distributing dividends.

This combination depressed profits that rendered European banks un-investable for international investors, with a RoE well below that of their US peers and, what is worse, lower than the estimated cost of equity, which gauges the compensation investors demand for purchasing and holding bank equity.

For comparison, at the onset of the Covid-19 pandemic in March 2020, the average RoE in the EU banking sector was 1.3%, showing significant dispersion across countries (the Italian banks’ average RoE was -2.1%). But the result of stricter regulation has been a strengthened and well-capitalised banking sector, as confirmed by the 2023 stress test results.

While banks are now profiting from the new interest rate scenario, the ultimate long-term effect of heightened interest rates on bank performance remains uncertain.

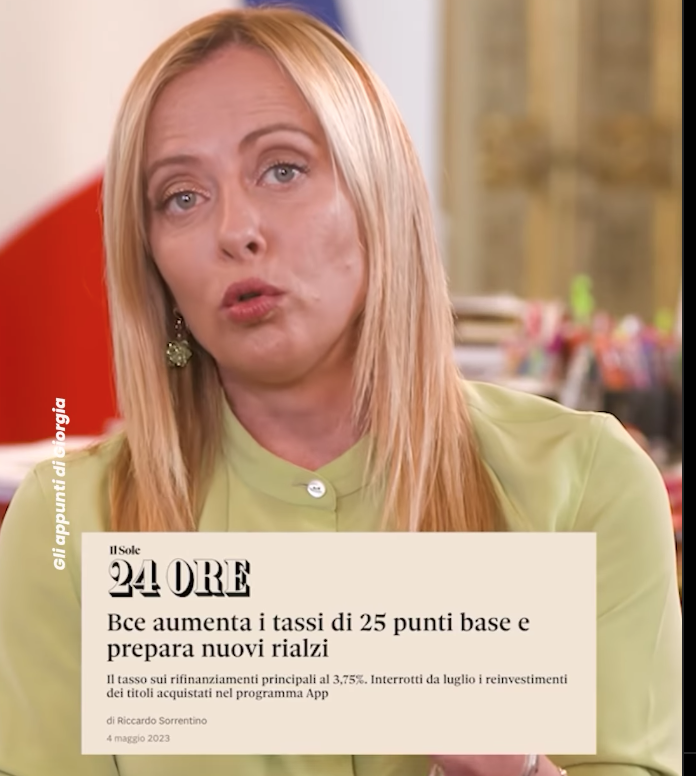

Funding costs are anticipated to rise. In October of 2022 the ECB changed the terms of its targeted longer-term refinancing operations (TLTRO) pushing banks towards early repayment.

This means banks now have to replace cheap central bank funding with more expensive sources. On the asset side, their impact on loan portfolio quality could be detrimental.

High interest rates and inflation often correspond with reduced economic growth and declining credit demand, potentially undermining borrowers’ creditworthiness. In perspective, banks might encounter heightened credit risk.

Managing this effectively requires banks to increase loan loss provisions, with adequate profit margins serving as a prerequisite for prudent provisioning. This holds significant relevance for Italian banks that had previously experienced large exposure to non-performing loans.

At the same time, banks have been asked by their supervisors to address digitalisation and climate change challenges. Digitalisation is important to rationalize bank organisational structure (and potentially reduce operating costs) but it is a cumbersome process, which may also pose new risks to the banking system.

Cyber risk, for example, may stem from the outsourcing of critical services to countries facing higher geopolitical risks, which may be more vulnerable to retaliatory cyberattacks in response to Western sanctions against Russia.

The need to face the challenges and opportunities of climate transition has become another priority for banks. Risks associated with climate change are already materialising. The intensification of extreme weather events in Europe has highlighted the increasing likelihood and severity of physical risk losses.

The results of the 2022 ECB climate risk stress test show that banks are making progress in dealing with climate and environmental related risks. However, their income relies heavily on higher-emitting industries and is misaligned with the ECB’s supervisory expectations.

Filling this gap is important, as banks are primary actors in the transition process. Yet, incorporating climate-related risks within the bank’s business operations entails a significant amount of financial, technological and human resources.

A few EU member states, including Spain and Italy, have either introduced or announced the introduction of a windfall tax on banks' profit margins resulting from higher interest rates: Actions eroding bank profits have an impact on bank capitalisation and, at an extreme level, on financial stability

Understanding the Big Picture

Furthermore, alongside shifts in interest rates and market yields, the cost of equity may rise. This means banks might again face the “return dilemma”, which arises when the returns demanded by investors are lower than those achieved by banks.

Bank investors, as equity providers, play a crucial role in this context due to the pivotal function capital plays in affecting banking stability. Equity not only supports operations and is a funding source for a bank’s assets. Even more critically, it absorbs losses and safeguards depositors and creditors.

A thinly capitalized bank leaves minimal room for error, where a substantial unexpected loan loss could leave the bank and its depositors vulnerable due to inadequate capital protection.

Potentially, low capital buffers might curtail a bank’s capacity to supply credit to the economy or amplify risk-taking when banks are unprofitable and undercapitalized. But, capital adequacy cannot be realized without sustainable profitability. These two concepts are inherently intertwined.

Hence, sustainable and stable profits are highly desirable from a supervisory perspective, fostering the bank’s capacity to generate internal capital through retained earnings and attract potential investors for capitalisation when necessary. This explains why any measures affecting banks’ profitability and capitalisation are under the supervisory scrutiny.

Since last year, a few EU member states, including Spain and Italy, have either introduced or announced the introduction of a windfall tax on banks' profit margins resulting from higher interest rates. Not surprisingly, the immediate reaction of banks and investors was negative, impacting a sector that has experienced low returns for a long time.

However, these measures are also bound to raise supervisory concerns. First, as discussed above, actions eroding bank profits have an impact on bank capitalisation and, at an extreme level, on financial stability.

Second, they may impair banks’ ability to undertake the transformation required to face the digitalization and climate-related challenges, for which adequate capitalisation is a prerequisite.

Third, country-specific measures may increase political risk, exacerbating disparities across jurisdictions. Increased political risk threatens the level playing field in Europe distorting competition and making banks from certain countries more appealing to investors for reasons unrelated to the banks' specific characteristics.

It follows that although the banks’ net interest margin has so far benefited from higher interest rates, the issue at hand is not merely the magnitude of bank profits in the short term, but rather the ability of the banking sector to generate sustainable profits in the medium to long term, considering the aforementioned constraints and the emergence of traditional and new risks within an uncertain macro-scenario.

Just as all that glitters is not gold, any actions affecting the banks’ profitability and capitalisation should be meticulously designed and executed, requiring a comprehensive understanding of the “big picture”.

IEP@BU does not express opinions of its own. The opinions expressed in this publication are those of the authors. Any errors or omissions are the responsibility of the authors.