The ECB’s Choices in the Face of Trump’s Tariffs

The ECB might counterbalance the impact of tariffs by steering the exchange rate, but that would be a mistake. Maintaining a focus on price stability is paramount.

Following President Donald Trump’s decisions on tariffs, the ball is now in Europe’s court. In addition to any commercial countermeasures and the potential negotiations that may be initiated with the US administration, all eyes are on the European Central Bank (ECB).

Many are wondering how US tariffs will affect the trajectory of interest rate reductions in the euro area, a topic that will already be on the table in Frankfurt in the coming days.

Taking inspiration from the article written over fifty years ago by Milton Friedman on the role of monetary policy—still the lodestar for any central banker—it is useful to distinguish between what monetary policy can do and what it cannot (or must not) do.

Starting with the latter, it is important to recognise that monetary policy cannot offset the distortions caused by tariffs.

If the ECB were to adopt an aggressively expansionary monetary policy by repeatedly cutting interest rates, it could—in theory—generate a sufficient depreciation of the euro to compensate for the loss of competitiveness caused by tariffs.

In reality, that would be a mistake, comparable to those made by certain European central banks in the early 1970s following the first oil shock. There are several reasons for this.

First, the euro would have to depreciate significantly to offset tariffs of the kind imposed by the United States. That would require a drastic cut in interest rates, inevitably pushing up inflation, particularly through higher import prices.

Moreover, it is not certain that the central bank would even succeed in its aim because exchange rates depend on many factors, including capital flows that reflect differing expectations across economies.

One should not overlook the fact that immediately after the tariffs were announced, the euro actually strengthened against the dollar, exceeding the 1.10 threshold.

Finally, a sharp depreciation of the euro would offer the US Treasury a perfect pretext to accuse Europe of currency manipulation and impose further sanctions.

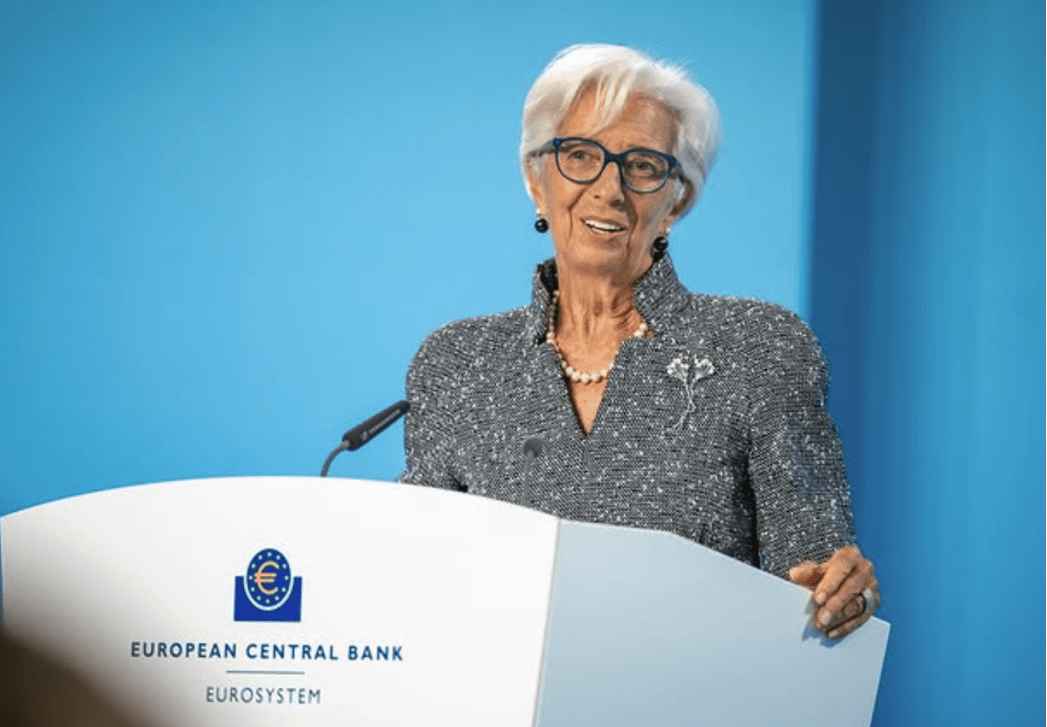

Fortunately, the ECB has no intention of adjusting its monetary policy with an exchange-rate target in mind, as has been repeatedly emphasised in the past by all its presidents, from Duisenberg to Trichet, and from Draghi to Lagarde.

Another thing monetary policy must not do is add further uncertainty to the current situation.

This calls for greater discipline in public communications by members of the Governing Council, where messages are not always perfectly aligned.

It also requires a clear and persuasive explanation of the underlying factors behind monetary policy decisions, particularly regarding the outlook for growth and inflation.

Even under uncertainty—which makes forecasting extremely difficult—it is not credible to base monetary policy solely on backward-looking data or wait to gauge the impact of the tariffs once official statistics have been published.

Given the scale of the measures taken by the United States, it is reasonable to anticipate a strongly negative impact on economic growth across the board, including in Europe. This will inevitably dampen global demand, including demand for commodities.

It is no coincidence that Brent crude prices fell by more than 5% in a matter of hours after the announcement. Gold prices also declined, reflecting expectations of global deflation.

As for inflation, its impact is likely to be negative as well, aside from the temporary effect on price levels tied to tariffs—something that is expected to affect the United States in particular.

In short, one can only hope that the ECB will hold its course during the storm and continue focusing on its primary objective: price stability.

Given the increased downside risks to both growth and inflation, it is likely that the current monetary policy stance is still too restrictive, leaving room for further interest rate cuts—measures that should not be postponed for too long.

One may also hope the ECB revises the pace at which it is implementing so-called quantitative tightening, which seeks to reduce the size of its balance sheet by declining to reinvest proceeds from maturing securities—thereby draining liquidity from the financial system.

Continuing along this path risks creating monetary conditions that are overly restrictive and long-term interest rates that are too high relative to the new macroeconomic environment.

IEP@BU does not express opinions of its own. The opinions expressed in this publication are those of the authors. Any errors or omissions are the responsibility of the authors.