The window of opportunity is still open for the Italian NRRP

A continuous political drive will be necessary, at all levels of government, to guarantee enough momentum in terms of both the necessary implementation of the approved reforms, and the timely disbursement of the sum related to already authorized public investments.

During summer 2023, the Italian government has requested an important revision of 57 initiatives, out of around 300 composing the NRRP

In early October 2023, Italy has received the payment of the third instalment of the plan, for €18.5 billion. During summer 2023, the government has also started the procedures to obtain the fourth instalment, while at the same time requesting an important revision of 57 initiatives, out of around 300 composing the NRRP.

While at the time of writing the outcome of the request is still under the evaluation of the European Commission, an analysis of the revised initiatives herein detailed points at a lower overall complexity of the ‘new’ NRRP, with the clear aim of an acceleration in the plan’s execution by the Italian government.

Administrative and Technical Hurdles

The story of the third NRRP instalment is symptomatic of the administrative and technical issues that have originally plagued parts of the Plan.

The instalment was requested already in December 2022 for a total amount of €19 billion but then suspended for almost seven months due to lengthy verification procedures, and some problems in the actual achievement of some of the agreed-upon outcomes.

For example, one initiative related to the setup of new student residencies was considered to have been fulfilled only partially.

In fact, while the government recorded as ‘new capacity’ the availability of beds for students in private guesthouses, the European Commission was explicitly aiming at new university-managed residencies.

This entailed a reduction of €500M million in the original amount of the instalment, to be transferred back once the new residencies will be ready.

The latter episode is testimony to the novelty in the management of public investment brought about by NRRP within the Italian administration.

To better understand the organization of the NRRP funding, one has to look at the working of the Recovery and Resilience Facility, the financing arm of the plan.

A ‘facility’ is different from a ‘fund’, as reporting and audit activities on the financing lines are not centered on expenditures (typical of any public funding), but instead on specific outcomes, which are established jointly by the Member State with the European Commission, together with the destination of the resources.

Every six months, the European Commission checks the fulfillment of the deadlines set down in the plan.

Only after this verification, the Commission disburses the resources as agreed. Underpinning this process is an Operating Agreement (OA) that every member State has signed with the EC, with quarterly assessments aimed at monitoring the progress of the NRRPs.

The Italian plan sets down nearly 300 initiatives (‘measures’) to be achieved until 2026, to which are associated 527 milestones or targets.

Milestones are assessed in a qualitative way, and usually have to do with the approval of regulatory or administrative measures, typically associated with reforms.

Targets are verified with quantitative indicators (for example, the number of beds in new student residencies), and are typically tied to investments. Italy’s Plan sets a total of 213 milestones and 314 targets.

Since last year, however, operational arrangements have been the target of a number of revisions across Member States, given the dramatic change in the geo-political and economic scenario. In the case of Italy, the third Semi-Annual Report on the NRRP, released at the end of May 2023, has identified 118 measures that are encountering challenges.

Some categories of challenges are internal, in that they include regulatory, administrative, and managerial hurdles, as well as the need to rewrite some of the original operational agreements due to an imperfect definition at the time of the first negotiation of the document.

Instead, 57 measures have been classified as having “objective difficulties”, mainly due to changes in the geopolitical scenario over the last two years, in terms of increased costs, scarcity of materials, or supply disruptions.

The value of these measures is close to 95 billion euros, nearly half of the total RRF funds allocated.

Hence the need to revise the Plan, in line with the experience of other countries. Moreover, all NRRPs during 2023 have had to ‘make room’ for the REPowerEU initiative, the European Commission’s plan introduced in 2022 aimed at accelerating energy independence from Russia and advancing the ecological transition.

To this extent, the Italian NRRP’s revision proposal mainly suggests adjustments to the Plan’s timeline and goals (Milestones and Targets), but largely retains the funding allocation for most initiatives.

Still, in the proposal, few measures are omitted entirely from the Plan, with the aim of focusing all available EU resources on initiatives that promise better efficiency in terms of time and outcomes.

Specifically, the revision suggests the removal of 9 investments from the NRRP, amounting to roughly €15.9 billion, approximately 8% of the entire Plan.

These include, among others, measures focused on the territorial enhancement and energy efficiency of municipalities (€6 billion), urban regeneration projects (€3.3 billion) and integrated urban plans (€2.5 billion).

However, the exclusion does not imply a total dismissal of these projects, as these initiatives are going be financed by alternative national funds, partly linked to EU structural funds, thus allowing for extended deadlines (2029 vs. 2026) and a less stringent conditionality with respect to the OAs.

The Effects of the Proposed Revision

Utilizing public microdata available from ReGiS, the official NRRP’s monitoring platform that provides a breakdown of each measure on a project by project basis, the PNRR Lab of SDA Bocconi has analyzed the nature of individual projects within the proposal to “defund” these measures, deriving some insight into the rationale for modifying them.

For 3 out of the 9 measures under scrutiny, the ReGiS platform displays no active projects (namely, Promotion of Innovative Installations, including offshore; Hydrogen Use in Hard-to-Abate Sectors; and Measures for Flood Risk Management and Hydrogeological Risk Reduction). The remaining 4 measures collectively comprise about 43,000 investment projects (Figure 1).

The average project scale within these measures is considerably smaller than the NRRP’s overall average, standing at roughly €370,000 compared to an average of €780,000. These data thus underscore a significant fragmentation in resource and administrative allocation of the funds originally assigned to the measures suggested for deletion.

Such fragmentation might have led to project delays and implementation challenges, thereby justifying their removal.

In fact, data reveal that municipalities, many of which are relatively small and without the requisite expertise for the execution of the NRRP projects under their jurisdiction, were accountable for the implementation of nearly all (99.3%) of the about 43,000 small projects associated with the measures set for removal.

Many of these municipalities were suffering from considerable administrative overload, as they had to manage multiple investment projects and several hundred thousand euros in NRRP funding for each of their employees.

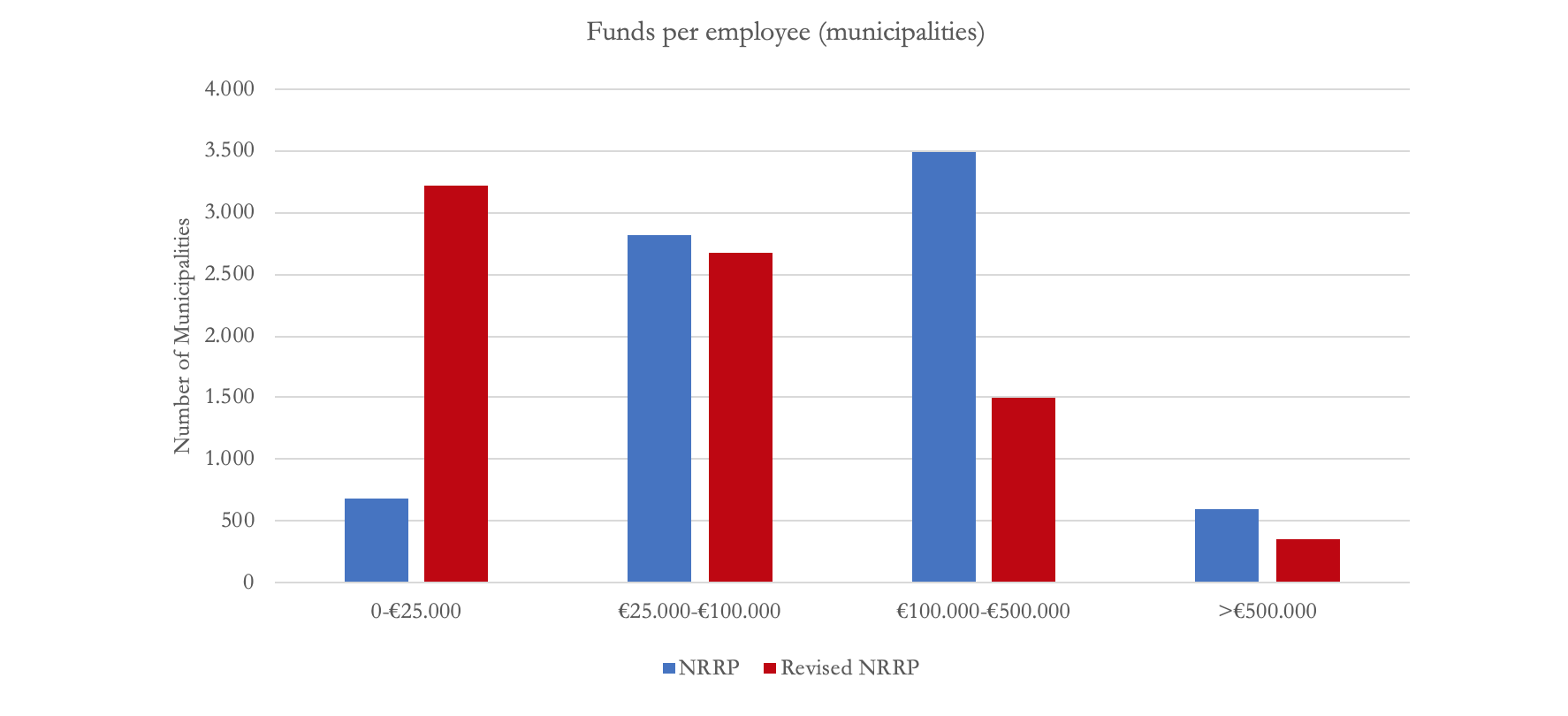

Data indeed show that through the revision of the Plan over 2,000 municipalities (from a total of roughly 7,600 for which we have information about the number of employees - approximately the 96% of all Italian municipalities) will see the ratio of NRRP funding per employee drop from above €100,000 to less than €25,000 (Figure 2).

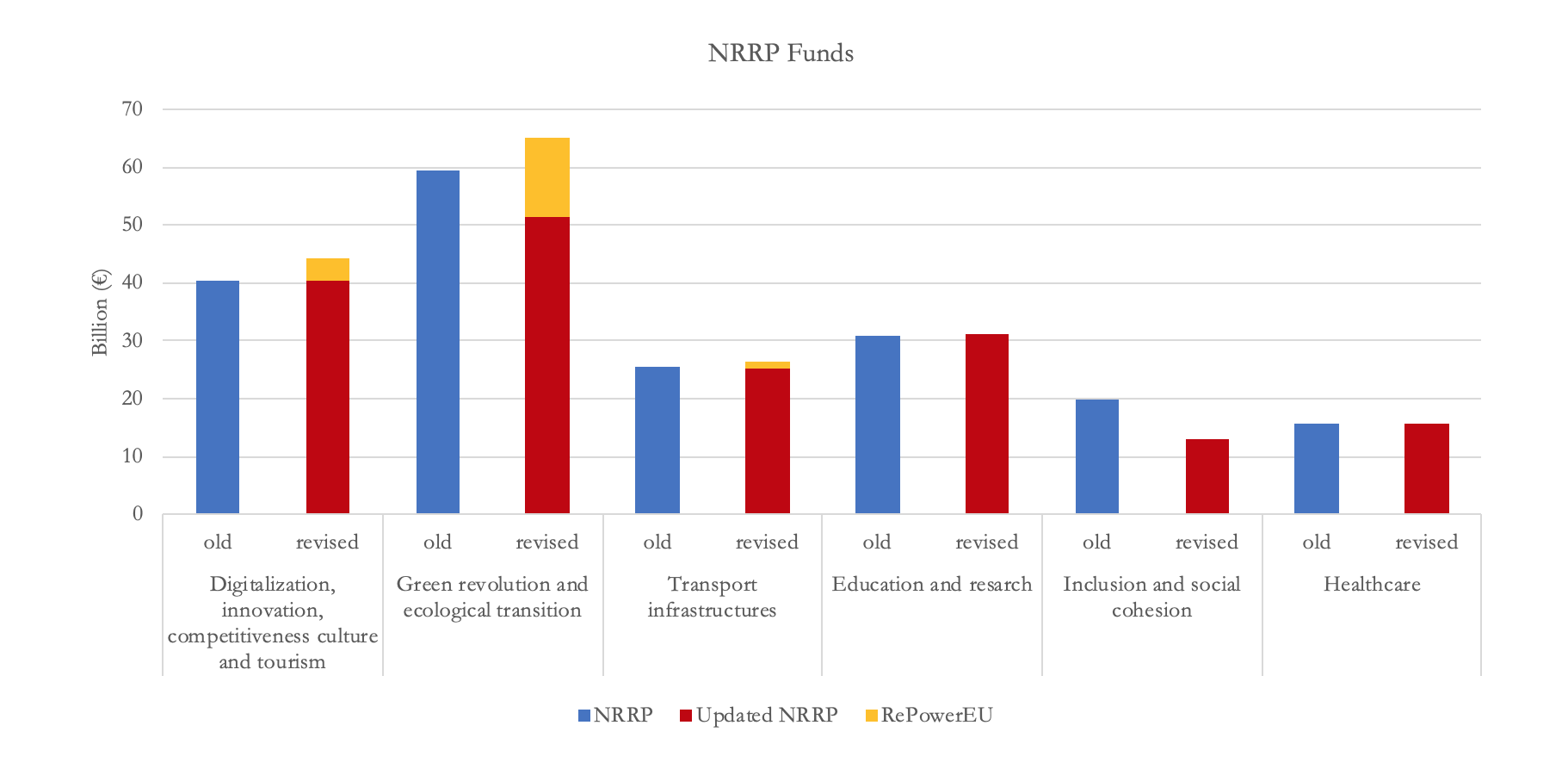

What happens to the €15.9 billion ‘saving’ obtained within the NRRP by cutting these 9 investments? The proposal of the Government is to merge these savings with the 2.8 billion additional loans that the EC has made available for Italy under the REPowerEU initiative.

Together with an augmented EU contribution to Italy based on the NRRP allocation guidelines (€150 million), and funds from the 2021-2027 Cohesion policies (roughly €450 million), the consolidated sum of €19.3 billion is directed towards new measures under the REPowerEU framework. In particular, the new measures are categorized into three main areas: electric and gas transport networks (€2.3 billion), green transition and energy efficiency (€14.8 billion), and backing for value chains (€2.1 billion).

An additional allocation of €101 million is reserved for the initiation of new energy-related reforms. Figure 3 illustrates the NRRP Missions’ value with the original version in blue, the proposed revision in red, and the new REPowerEU measures showcased in yellow.

Other elements also point at the idea that the primary aim of the suggested revisions to the Italian NRRP is an acceleration of the Plan’s execution, especially considering the 2026 deadline. As of July 2023, the official amount of funds disbursed and audited within the NRRP is €26.5 billion euros, or approximately 14% of the total €191.5 billion available.

Out of this €26.5 billion, a substantial €15.2 billion was allocated to tax credits for business ventures into advanced machinery and software (Transizione 4.0) and for building renovations enhancing energy efficiency (Ecobonus) — accounting for over 57% of the total official expenditure insofar.

The rationale of the proposed revision

Two comments are worth making here. First, the low figure of disbursed funds (14% as of July 2023) might hide a significant amount of resources already paid to economic operators during 2023, but not yet audited, and hence not recorded in official data.

This is due to the fact that official payments are recorded on ReGiS only when the managing entity of each project effectively draws funds from the central account of the Treasury, which might not necessary coincide with the actual payment, due to liquidity mismatches that, especially for public entities, can last several months.

Second, resources channeled through tax credits are easier to mobilize but might be audited with a delay (i.e. when the tax credit is requested).

On the one hand, it is therefore not surprising that 57% of the total official expenditure insofar has been channeled in this way; on the other hand, behind the low figures of disbursed funds insofar there might be the late auditing of these tax credits, yet to be accounted for during 2023. In any case, a significant share of the newly suggested measures in the revised Plan revolve around tax credits or similar subsidies: out of the €19.3 billion to be redirected, at least €9.5 billion of measures fall under this category: this includes a novel tax credit for business investments in digital and sustainable technologies (Transizione 5.0, earmarked at €4.0 billion), and additional allocations for the Ecobonus (€4.0 billion) for low-income families and public buildings. Additionally, €1.5 billion are designated for tax credits to support companies’ investments in renewable energy production.

The rationale of the proposed revision of the Italian NRRP, aimed at simplifying and streamlining its implementation, is thus evident. Whether the operation will be successful will be clear in the upcoming months, which will prove pivotal for the success of the NRRP.

The official opinion of the European Commission on the entire revision is expected by end of November, while the release of the fifth tranche of financing, amounting to €18 billion, hinges on meeting the pre-established Milestones and Targets by December’s end. Specifically, this refers to 23 Milestones and 46 Targets as outlined in the Plan’s initial version.

The government suggests deferring some of these goals, specifically those tied to the ultra-broadband connection for smaller islands, the development of bike lanes, water infrastructure enhancements, reforms of the ITS (Technical and Vocational Education and Training Institutes), and the Universal Civil Service.

Concurrently, the government has also put forth a recommendation to introduce the creation of a Special Economic Zone (SEZ) covering the entire southern region of the nation into the NRRP. On all these requests we are awaiting an evaluation by the European Commission.

Data reveal that municipalities, many of which lack the expertise to execute NRRP projects, were accountable for the implementation of nearly all of the about 43,000 small projects associated with the measures set for removal

A Window of Opportunity

In conclusion, it is evident that the Italian NRRP insofar has encountered a number of difficulties: the initial excessive fragmentation of the planned investments; the necessary implementation of a number of administrative reforms and simplifications, approved by law but slowly enforced especially at the local level; the need to adapt the original plan to a dramatically changed economic and geo-political environment.

The low official figure of disbursed funds, and the request for a revision in relation to a number of measures, are testimony of these difficulties.

Nevertheless, a closer look at publicly available data on individual measures reveals that the ongoing situation is evolving, in directions that are consistent with an improvement in the implementation of milestones and targets, both in terms of timing and volume.

Clearly, a continuous drive will be necessary, at all levels of government, to guarantee enough momentum in terms of both the necessary implementation of the approved reforms and the timely disbursement of the sum related to already authorized public investments.

If supported by adequate political ambition and communication, placing the NRRP at the center of the policy agenda, the window of opportunity is thus still open for the success of the Plan.

IEP@BU does not express opinions of its own. The opinions expressed in this publication are those of the authors. Any errors or omissions are the responsibility of the authors.