Artificial Intelligence in Business and Economic Decisions under the Shadow of the EU Regulations

There's a prevailing skepticism regarding whether existing competition laws are equipped to curb the tendency of AI to foster prices above competitive levels, as these laws were originally crafted to target explicit collusion between companies

The lightning penetration of AI into our society is affecting how businesses operate by modifying how they make some of their most fundamental decisions.

Businesses are increasingly turning to algorithms that utilize data on consumer preferences to set their prices. In some instances, these algorithms employ a machine-learning process or even reinforcement-learning algorithms to craft advanced pricing strategies that adapt to the actions of both consumers and rivals.

The role of artificial intelligence (AI) algorithms in shaping the pricing policies of companies is steadily increasing. This is especially evident in sectors that are more technologically driven and that operate online, but it is also becoming widespread in any industry with access to extensive data on market demand and competitive dynamics conducive to such advancements. Powered by this information, AI algorithms are programmed to identify the most profitable pricing tactics through a process of trial and error.

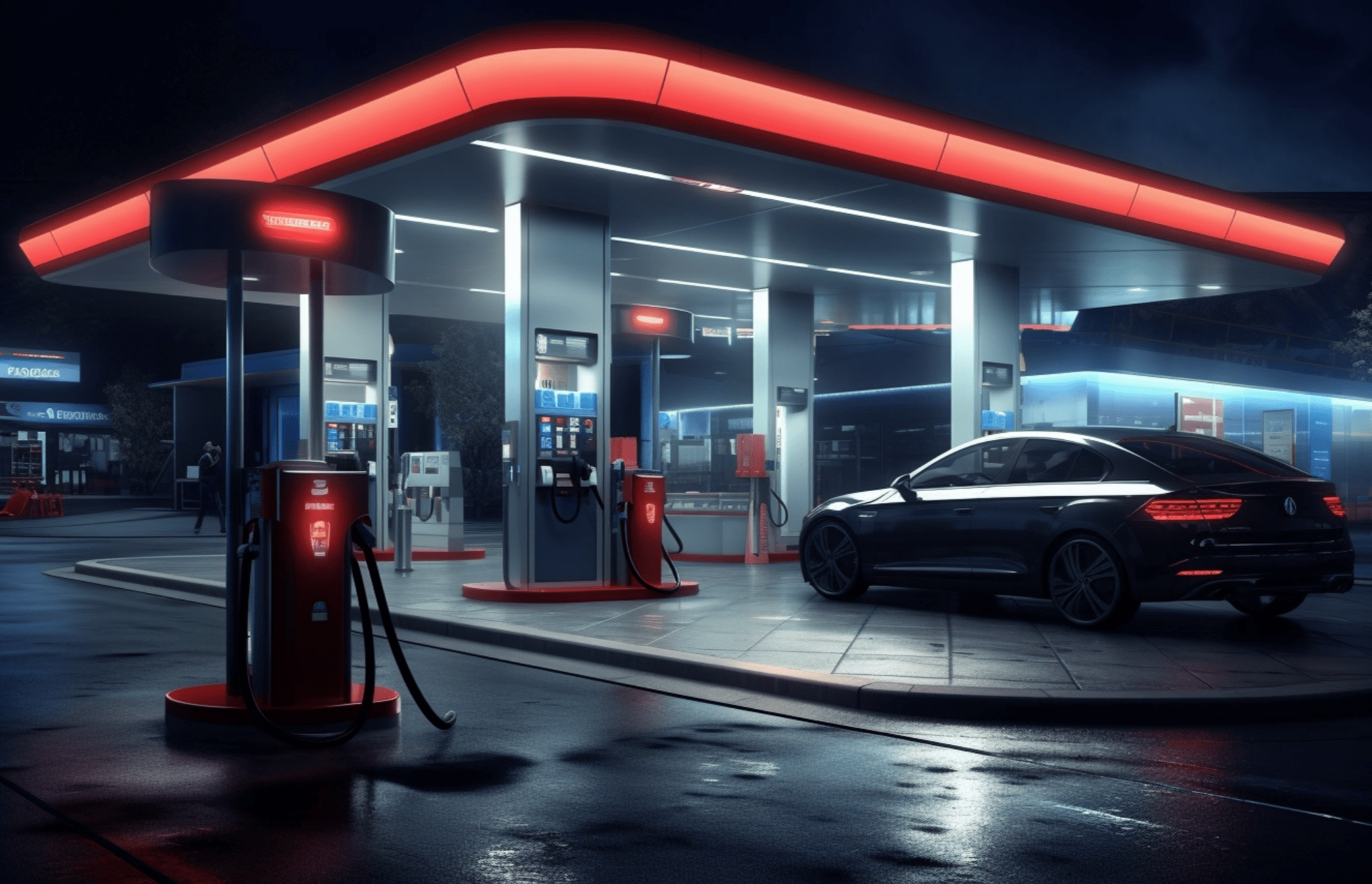

The shift to algorithmic pricing by German gasoline retailers has been associated with a dramatic increase in profit margins, by as much as 38%

Algorithm-Based Pricing

What implications does this shift towards algorithm-based pricing decisions hold for the future? There's still a limited amount of empirical research on the effects of implementing AI algorithms for pricing, but a few instances have garnered significant attention.

Notably, the use of algorithmic pricing tools in the German retail gasoline market has been widespread since mid-2017. An analysis of detailed price data before and after the introduction of these algorithms revealed a notable finding: the shift to algorithmic pricing by German gasoline retailers has been associated with a dramatic increase in profit margins, by as much as 38%.

A challenge with such studies is the difficulty in pinpointing the precise moment different gasoline stations started using algorithms and identifying the specific types of AI algorithms implemented, as these details are typically not accessible to external analysts.

In the research focusing on the German gasoline market, the researchers were able to determine which stations had begun using algorithmic pricing tools and the timing of their adoption through a statistical method.

This approach is particularly insightful because it leverages the unique characteristics expected of an algorithmic pricing system.

Specifically, algorithm-driven prices are likely to differ from those set by humans in several ways: (i) the frequency of price adjustments within a single day, (ii) the average magnitude of these adjustments, and (iii) how quickly a station's prices are updated in response to a competitor's price change. These aspects are precisely what companies offering pricing software claim can have a beneficial impact on retailers' margins.

But why and how does AI lead to increased prices? In the German petrol market example, it was observed that profit margins steadily increased, hinting that algorithms require time to learn and evolve towards strategies that implicitly favor collusion, where AI opts for less competitive pricing than what might be seen in a fully competitive environment.

Essentially, algorithms develop cooperative pricing strategies that result in higher prices. While this scenario may boost company profits, it also clearly harms consumers.

Such findings have sparked a vigorous legal and political debate about the potential for AI in pricing to encourage collusion, whether intentional or inadvertent. This issue has become a focal point for antitrust regulators, business groups, and experts in competition law.

There's a prevailing skepticism regarding whether existing competition laws are equipped to curb the tendency of AI to foster prices above competitive levels, as these laws were originally crafted to target explicit collusion between companies.

The debate over the impact of artificial intelligence on pricing systems and its eventual repercussions for businesses and consumers is far from settled.

Due to the scarcity of empirical data, current studies are largely theoretical or experimental, aiming to assess AI's effects. While some research highlights increased collusion in pricing as companies learn from each other's strategies, other studies suggest that AI could lead to more aggressive pricing by improving demand forecasts, potentially reducing prices and making collusion less feasible.

The critical importance of data, the very lifeblood of AI algorithms, cannot be overlooked: control over data dictates the nature and success of the algorithms applied to it. This principle is at the heart of a recent study by a team from Bocconi University, including Francesco Decarolis, Michele Rovigatti, Ksenia Shakhgildyan, and Gabriele Rovigatti from the Bank of Italy.

This research explores how a digital platform (like Google, for instance) can influence the bidding strategies of advertisers through its management of data types, quality, and distribution frequency. This, in turn, affects which AI algorithms advertisers use and the impact these choices have on final pricing in auctions for advertising space.

This is an example of the significant changes that are undergoing in the digital advertising world, which is a crucial revenue stream for both the large digital platforms and the publishers.

Algorithms develop cooperative pricing strategies that result in higher prices. While this scenario may boost company profits, it also clearly harms consumers

The Impact of Digital EU Regulation

Some of these market evolutions, however, are not driven by technological innovations but by regulatory interventions. The EU has a well-defined position globally as the regulator of the tech sector: from the GDPR to the more recent Digital Markets Act (DMA) and Digital Services Act, and to the forthcoming approval of the AI Act Regulation and the future AI Liability Directive.

These regulations all seek to guide and govern Europe in its digital transition and put a clear emphasis on the risks of the digital world, especially in terms of processing personal data.

With regard to Artificial Intelligence, however, the debate within Europe is still intense. Although we are only a few months away from the final text of the AI Act (which most likely will come this April), several voices are very critical.

The French government and the main AI French business, for instance, have been compact in stressing the potential damages to AI innovation associated with certain provisions of the AI Act.

Indeed, while there tends to be a shared agreement on the need to prohibit certain AI applications, like algorithms exploiting vulnerabilities, or using subliminal techniques, or performing social scoring, the greatest concerns regard the burden on businesses that will be associated with the transparency obligations and the implementation of risk mitigation systems.

Although these two latter sets of provisions will be implemented only gradually (after one year the transparency and after two years the risk mitigation), they will necessarily entail extra costs for EU-based firms. Thus, risking to further deepen the gap with US and China on AI development.

Finally, it shall be recalled that the challenges ahead regarding AI regulation come at a moment in time when the EU is still facing the complex task of making its two most recently adopted regulations on digital work: the Digital Services Act started to apply to the largest platforms at the end of August 2023, while the Digital Markets Act will have its prohibitions effective from March 2024.

Both acts impose major changes on how online businesses operate and, if the Digital Services Act has the clear goal of making the internet safer for users, the economic impacts of regulating business-to-platform interactions through the Digital Markets Act are harder to assess.

Digital markets have many features that obstacle the functioning of competition and firm entry, and that are the key motivation of the EU regulatory intervention. Most of these features are connected to the role of data and, revolve around scale economies and barriers to entry, network effects, switching costs, and user behavioral biases.

Whether the EU intervention to regulate digital markets will succeed in fixing distortions in digital markets is a fundamental, yet unsolved question.

Francesco Dearolis, IEP@BU Fellow and Full Professor of Economics at Bocconi University, will be a speaker at the IEP@BU-ECFR-SDA event A Europe fit for the digital age: dream or reality, on February 27, in Rome.

He will debate with Ulrike Franke, Senior policy fellow at ECFR and leader of the Technology and European Power initiative.

Stefano Feltri will moderate the conversation. The event is by invitation, if you are interested, please reach us at iep@unibocconi.it

IEP@BU does not express opinions of its own. The opinions expressed in this publication are those of the authors. Any errors or omissions are the responsibility of the authors.