Policy Brief 53 - Paying for the Critical Minerals of the Low-Carbon Transition

An exploration of the ‘viability space’ between exporters’ fiscal revenues and electric vehicle affordability. A Policy Brief by Romain Svartzman, and Leonard Weber

-

FilePB53_Critical Minerals .pdf (754.44 KB)

Executive Summary

The low-carbon energy transition is highly dependent on critical minerals (CMs), whose prices are expected to increase. This raises the question of whether higher CM prices could improve fiscal revenues in low- and middle-income countries (LMICs) that export these minerals, and whether such gains would come at the cost of reduced affordability of low-carbon technologies.

This paper contributes to quantifying this trade-off by examining the joint effects of higher prices for four critical minerals – cobalt, copper, lithium, and nickel – on fiscal revenues in exporting LMICs and on the prices of electric vehicles (EVs). Using data on mineral production, current fiscal revenues (including from mining), EV material intensities across battery technologies (NMC 811, NCA, and LFP), and projected CM prices, we construct stylized scenarios in which a 5 percent levy would be applied by the exporting countries to mineral values.

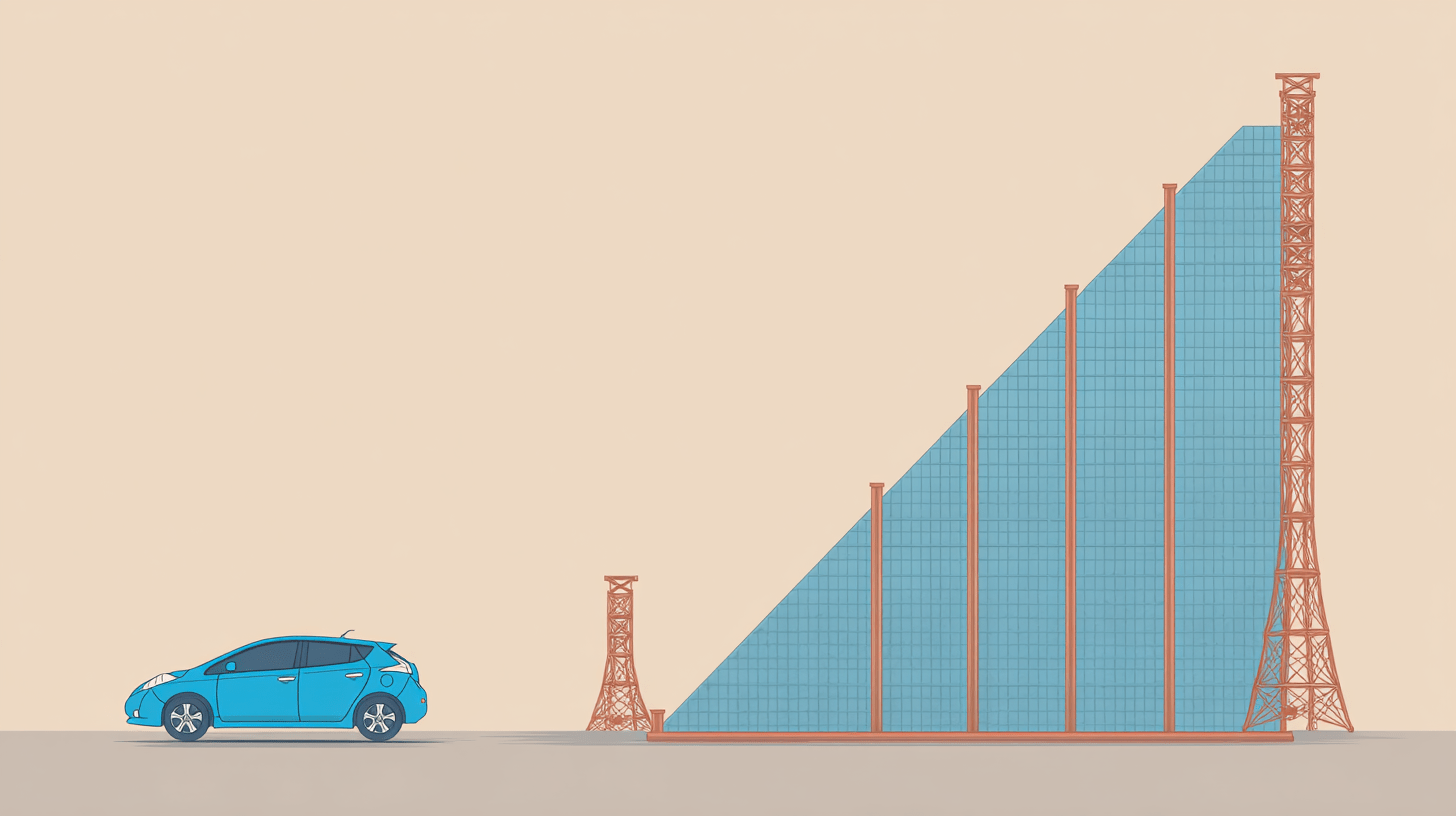

We find that a sizeable viability space exists between exporter revenues and EV affordability: even under substantially higher CM prices, fiscal revenues in several exporting LMICs could increase markedly while EV prices would rise only modestly.

Despite several methodological limitations, including the omission of the CM processing stage, which is largely controlled by Chinese firms, these results suggest that higher CM prices need not pose a binding constraint on the low-carbon transition and may support policy approaches based on fair trade and international cooperation between mineral-exporting LMICs and importing economies.

IEP@BU does not express opinions of its own. The opinions expressed in this publication are those of the authors. Any errors or omissions are the responsibility of the authors.