European Reaction to Reciprocal Tariffs: How to Benefit from Economic Illiteracy

The advantages of the Trump administration's ‘reciprocal’ tariff structure for EU industry on the US market are likely to outweigh the direct impact of the 20% tariff that EU exports will now face. A commentary by Daniel Gros

Liberation Day has come, and we now know what tariffs the US intends to impose on its trading partners. The rates range from a minimum base of 10 % to 20 % for the EU, 33 % for China, and even higher for emerging markets like Vietnam.

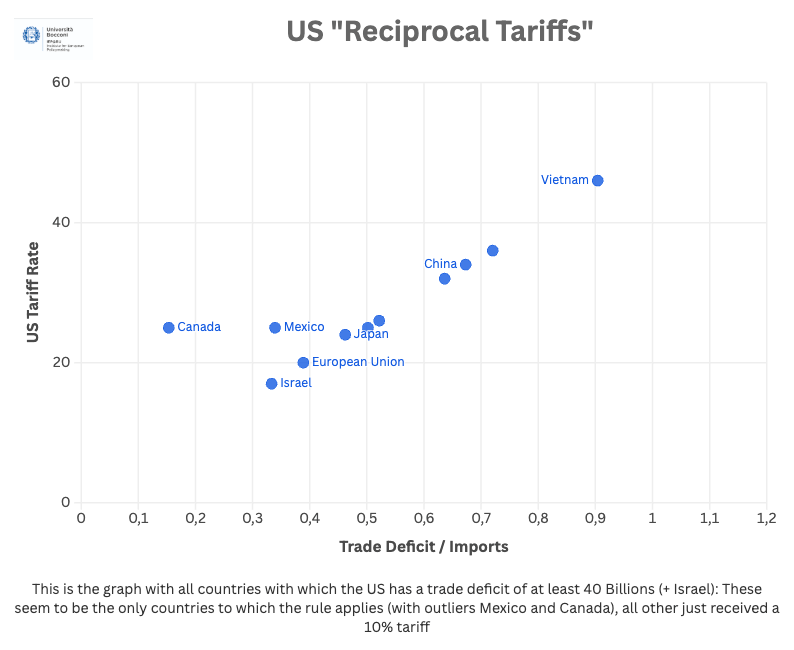

The basis for these different rates is the different bilateral trade deficits of the US with these countries.

As the office of the USTR explains, the administration simply took the bilateral trade deficit as a proportion of imports to calculate the tariff equivalent of the trade distortions that, in the eye of the US, caused this deficit. Trump then graciously divided this number by 2 to establish the ‘reciprocal’ tariff.

The bilateral trade balances were calculated only based on goods trade, where the US has large deficits, not taking into account services trade, on which the US has a substantial surplus.

Moreover, there is an obvious inconsistency in the basic argument that a trade deficit is caused by foreign distortions (justifying US ‘reciprocal’ tariffs), but a surplus does not justify foreign tariffs; on the contrary, the US imposes a tariff of 10 %.

Never mind that this procedure does not make any sense. The rest of the world has to deal with the situation as it is.

For the EU the key point is that the outcome is not very different from the 60 % (on China) - 20 % (everybody else) announced during the campaign. The ‘reciprocal’ tariffs announced on April 2nd are in addition to existing tariffs.

Given that tariffs on China were already increased by 20 % in two steps over the last month, this implies that US tariffs on imports from China will now increase to over 53 %, since there were already other tariffs from Trump I.

By contrast, tariffs on EU goods were mostly close to zero, implying that the total tariff rates resulting from Liberation Day will be only slightly higher than 20 %. Moreover, the ‘reciprocal’ tariffs will also be larger on other major competitors, like Japan or Korea (24/25 %) and even more on Taiwan and Thailand (over 30%). Finally, pharmaceutical products, which have been exempted from reciprocal tariffs, make up a large share of EU exports to the US.

The difference in rates with China (and other Asian competitors) is key for Europe, since Chinese producers are in many industries the strongest and largest competitors for EU industry. The tariff structure just announced thus provides EU exporters with an important competitive advantage over their Chinese (and other Asian producers).

Moreover, many European manufacturing firms have important plants in the US. They will also be able to increase their prices and profits (unless the tariffs put the US into a recession). This is also different from their Chinese competitors, who have almost no production facilities in the US.

This 40 percentage points advantage over China in this ‘reciprocal’ tariff structure offers EU industry on the US market are likely to outweigh the direct impact of the 20 % tariff EU exports will now face.

Many in Europe fear a ‘flood’ of Chinese imports arriving from China that are diverted from the US market because of the much higher tariffs there.

However, the relative advantage over China in the large US market provides a strong offsetting factor. European consumers will benefit from cheaper Chinese goods, and European producers will have more export and profit opportunities in the US.

Economists like to stress that trade is about comparative advantage. In this case, Trump has given the EU a strong comparative advantage, or at least less of a disadvantage than others.

The tariff structure just announced provides EU exporters with an important competitive advantage over their Chinese (and other Asian producers).

IEP@BU does not express opinions of its own. The opinions expressed in this publication are those of the authors. Any errors or omissions are the responsibility of the authors.