On the Amato et al. proposal for a European Debt Agency: a preliminary legal analysis

A preliminary legal analysis of the proposal for a European Debt Agency (EDA). EDA represents a ground-breaking initiative to address the complex challenges of sovereign debt management within the European Union. A Working Paper by Rosalba Famà, and Maria Antonia Panascì

-

File

Executive Summary

This working paper offers a preliminary legal analysis of the proposal for a European Debt Agency (EDA) advanced by a team of economists led by Massimo Amato. EDA represents a ground-breaking initiative to address the complex challenges of sovereign debt management within the European Union. Fundamentally, it seeks to reimagine how EU Member States manage their public debt, offering a sophisticated solution that aims to balance market efficiency, fiscal responsibility, and economic stability. This working paper aims to determine whether the establishment of EDA is feasible within the existing EU legal framework. To this end, the paper first explains EDA’s functioning, then assesses its compatibility with the existing EU Treaties, and examines different alternative ways EDA could be built. Finally, the paper explores EDA’s possible institutional design and its relationship with EU fiscal rules. Given the current challenging international scenario, massive defence investments will compel indebted Member States to deviate from fiscal rules, potentially triggering market tensions and deteriorating public finance balances with increased risks for the most vulnerable economies.

A coordinated European response, such as establishing a European Debt Agency, could mitigate these risks by efficiently managing defence financing across member countries. Therefore, the legal evaluation of the EDA has nowadays acquired an unprecedented relevance.

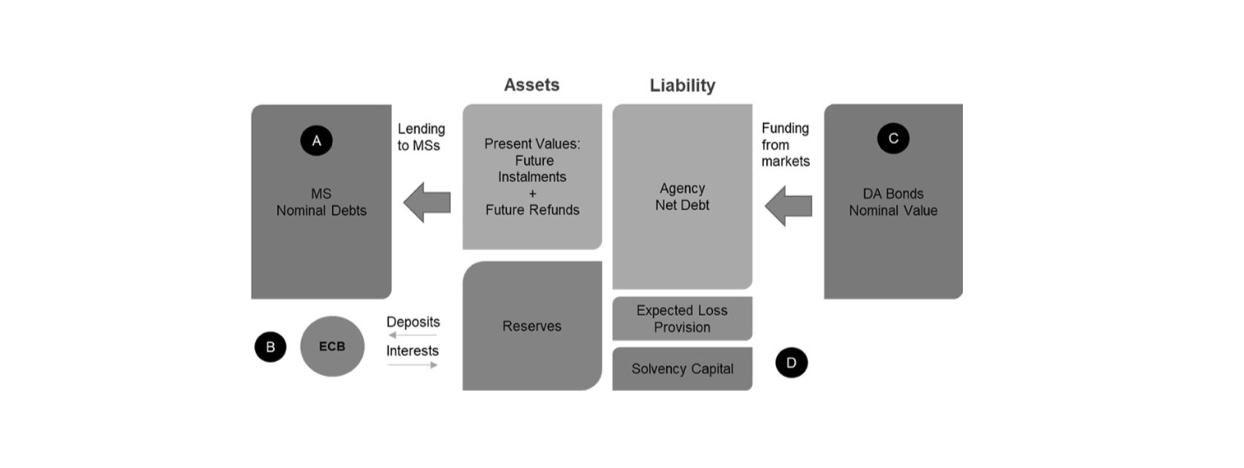

1. EDA’s functioning. At its core, EDA is not a debt mutualization mechanism, as might be initially assumed, but rather an innovative financial engineering structure designed to filter market sentiment and realign interest rates to more accurately reflect each Member State's fundamental economic risks. The agency would progressively absorb the entire Member States' debt by issuing bonds with finite maturity and providing perpetual loans to individual Member States. The loan pricing would be carefully calibrated to each state's specific economic fundamentals. Moreover, EDA’s functioning, particularly its pricing system, would also allow the creation of a reserve fund to mitigate potential default risks.

Under EDA, Member States are responsible only for the repayment of the loans received. Liabilities are strictly pro rata, as the EDA’s guarantee-scheme is based on several but not joint guarantees fixed ex ante. This approach avoids mutualisation and ensures that each Member State is liable for its own share of debt issuance.

Fig. 1 from Amato and others, ‘Europe, public debts, and safe assets: the scope for a European Debt Agency’ (2021) Economia Politica, p. 834. All rights reserved.

2. The compatibility of EDA with the EU legal framework; the main finding of the paper is that the establishment of EDA would be compatible with the existing EU Treaties. First, the paper places EDA within the scope of economic policy, an area in which the EU’s competence is limited to the coordination of national economic policies. It argues that the proposed agency complies with this “coordination competence”, as its role would be limited to the coordinated management of national debts while maintaining Member States’ fiscal responsibility under the no-bailout clause of Article 125 TFEU.

In compliance with Article 125 TFEU, EDA is explicitly designed to avoid debt mutualization. It would introduce a risk-based pricing system that preserves market discipline while providing a more efficient approach to debt management. Rather than redistributing income between Member States, EDA would price debt according to each country's individual fiscal fundamentals. This system ensures that each Member State remains responsible for its own debt, with borrowing costs reflecting its specific economic conditions.

Crucially, the proposed agency does not imply the assumption of Member States’ public debt, hence upholding the core principle of market discipline, which plays a central role in the EU framework of economic governance. The compatibility of EDA with EU law is subject to the requirement that Member States retain the prerogative to issue their own bonds, even if this option will not be economically convenient in practice. However, the current Treaty framework impedes an EDA that would entirely preclude national bond issuance.

The compatibility with budgetary principles is equally carefully considered. The EDA is not intended to finance the EU budget, but rather to provide a mechanism for managing member states' existing debt. This approach excludes frictions with the principle of budgetary balance under Article 310 TFEU, preserves the fundamental economic sovereignty of individual states while offering a more efficient debt management strategy.

The proposed mechanism also explores the possibility for EDA to play a role in the construction of an EU fiscal capacity. Indeed, EDA would be able to include a segregated portfolio for managing EU common debt for projects that the EU would like to pursue together, thus further alleviating the burden on national finances for those that can be regarded as European Common Goods. After Next Generation EU, it would not be unprecedented for the EU to assume debt to finance its common expenditure. However, this had happened under exceptional circumstances and following an approach that placed the debt outside the EU standard budget. The authors acknowledge that using EDA to fund the Union’s expenditure would require a more flexible reading of the existing budgetary principles.

Afterward, the paper explores the legal options available for the establishment of EDA, which depend on whether the agency would be created within or outside the existing Treaty framework and whether participation would be limited to Eurozone countries or open to all Member States. The options considered include Article 136 (1) TFEU, Article 352 TFEU, enhanced cooperation, Article 122 (2) TFEU, a simplified Treaty revision, or an international agreement. In the authors’ view, the most promising legal pathway appears to be the flexibility clause under Article 352 TFEU which allows for the creation of a mechanism such as EDA when existing Treaty provisions do not provide specific powers. This legal basis offers a pragmatic route to EDA’s implementation without requiring the ordinary Treaty revision, though it would still need unanimity within the Council.

3. EDA’s possible institutional design. EDA’s governance emerges as a crucial consideration in the EDA proposal. Bearing in mind that EDA will not entail the mutualisation of public debts and will not abandon the principle of market discipline, each State adhering to EDA will be rated based on its fundamentals. The rating and the inclusion of a Member State in a certain class of risk is, therefore, the most critical part of EDA’s functioning. Based on the rating of each State and the insertion into a specific class of risk, each State will pay a different interest rate attached to its loans. The authors recommend removing political influence from risk assessment by entrusting this critical function to an independent body, such as the European Fiscal Board. This approach aims to ensure that risk classification remains a technical, objective process, free from political pressure. Particularly, the analysis suggests avoiding direct Commission involvement to prevent political bias.

4. EDA and EU fiscal rules. The analysis also highlights potential substantial benefits of the EDA, such as by reducing interest rate spreads and speculation, the Agency would benefit States’ finances while maintaining fiscal discipline. Indeed, to the understanding of the authors, EDA’s promises to strengthen fiscal discipline by pricing loans according to each Member State's economic performance, while simultaneously offering a mechanism to normalize the European Central Bank's monetary policy. Also, by providing a euro-denominated safe asset, the agency could significantly enhance the economic stability of the Eurozone.

However, the proposal does not come without challenges. A key limitation is that the EDA would not be able to prevent Member States from issuing national bonds in case of excessive debt, which could potentially undermine its effectiveness. For this reason, the concrete EDA’s implementation would require strong institutional design.

Despite these challenges, the European Debt Agency represents a potentially transformative approach to EU economic governance. As the European Union continues to grapple with economic challenges, EDA presents a promising framework that balances technical innovation while respecting the Treaties.

Ultimately, the research calls for continued exploration, detailed feasibility studies, and engaged dialogue among stakeholders. The European Debt Agency may well represent the next frontier in European economic cooperation, a testament to the ongoing process of finding innovative solutions to complex economic challenges.

IEP@BU does not express opinions of its own. The opinions expressed in this publication are those of the authors. Any errors or omissions are the responsibility of the authors.