The Meloni Government's Budgetary Policy

Our analysis indicates that the budgetary documents presented by the Italian government are based on excessively optimistic forecasts regarding GDP growth, the effectiveness of budgetary measures and the revenues connected to privatizations. As a result, the very small projected decline in the public debt/GDP ratio is not likely.

The credibility of the policy objectives underlying the Meloni Government’s Update of the Economic and Finance Document (Nadef) and draft Budget Law is called into question by several factors. The worsening economic environment and the intrinsic weakness of Italian public finances cast doubts on the commitments made by the government, with severe potential implications for Italy’s financial stability.

In this commentary we highlight some of the key features of the of the government’s budgetary policies and the potential risks stemming from both a lower-than-expected economic growth and a higher public debt/GDP for the country's financial stability.

We conclude with some observations on the European policy framework with which the government policies will have to comply.

The macroeconomic framework

The Update of the Economic and Finance Document (Nadef) is based on the assumption of a 0.8% real GDP growth for Italy this year and 1.2% in 2024, 1.5% in 2025 and 1% in 2026 (Table 1).

This profile reflects the impact of a slightly expansionary budget next year, which would positively impact growth by 0.2 points in 2024 and 0.1 in 2025.

Table 1. The macroeconomic framework in the April Def and the September Nadef

(Percentages)

|

|

2022 |

2023 |

2024 |

2025 |

2026 |

|

Real GDP |

|

|

|

|

|

|

Def, programmatic scenario |

3.7 |

1.0 |

1.5 |

1.3 |

1.1 |

|

Nadef, trend scenario |

3.7 |

0.8 |

1.0 |

1.3 |

1.2 |

|

Nadef, programmatic scenario |

3.7 |

0.8 |

1.2 |

1.4 |

1.0 |

|

|

|

|

|

|

|

|

GDP Deflator |

|

|

|

|

|

|

Def, programmatic scenario |

3.0 |

4.8 |

2.7 |

2.0 |

2.0 |

|

Nadef, trend scenario |

3.0 |

4.5 |

2.9 |

2.1 |

2.0 |

|

Nadef, programmatic scenario |

3.0 |

4.5 |

2.9 |

2.1 |

2.1 |

|

|

|

|

|

|

|

|

Nominal GDP |

|

|

|

|

|

|

Def, programmatic scenario |

6.8 |

5.8 |

4.3 |

3.4 |

3.1 |

|

Nadef, trend scenario |

6.8 |

5.3 |

3.9 |

3.4 |

3.2 |

|

Nadef, programmatic scenario |

6.8 |

5.3 |

4.1 |

3.6 |

3.1 |

|

|

|

|

|

|

|

|

Private consumption deflator |

|

|

|

|

|

|

Def, programmatic scenario |

7.4 |

5.7 |

2.7 |

2.0 |

2.0 |

|

Nadef, trend scenario |

7.2 |

5.6 |

2.4 |

2.0 |

2.0 |

|

Nadef, programmatic scenario |

7.2 |

5.6 |

2.3 |

2.0 |

2.1 |

|

|

|

|

|

|

|

The GDP deflator is expected to fall to 2.9% in 2024, rising above Consumption deflator, due to a projected improvement in the terms of trade.

The macroeconomic assumptions appear overly optimistic. The GDP forecast for 2023-24 is based on the assumption that the Italian economy will start growing again in the third quarter of this year, at a pace of around 0.3% per cent; such a pace would be maintained over the next year, when the investments of the NRRP should start producing their effects.

This raises two main issues: the first concerns the ability to actually make all the foreseen investments; the second relates to the short-term effects of these investments on GDP, despite the postponement of many projects to 2025 and 2026.

Overall, the macro assumptions underlying the Nadef do not seem consistent with the underlying developments of the European and the Italian economy. The IMF recently revised downwards its forecasts for the euro area. Industrial activity continues to be weak, due to its dependence on foreign demand.

The negative dynamics in bank credit flows show that the severe monetary and credit tightening of the European Central Bank (ECB) is producing its effects, in particular a contraction in the construction sector, which is particularly sensitive to changes in credit availability. The positive performance of some traditional service sectors (tourism-catering-entertainment) was favored by the reduction of the excess savings accumulated by households (Italian and foreign) during the lockdown. The peak may, however, have been reached: the sector's confidence indicators have entered negative territory.

Nadef's forecasts also appear optimistic on inflation. The government's forecasts suggest a stronger slowdown in consumer prices than expected by analysts for the euro-area average. A higher than projected Italian inflation rate would erode households’ real incomes, which would result in a slower consumption growth.

Inflation and monetary policy

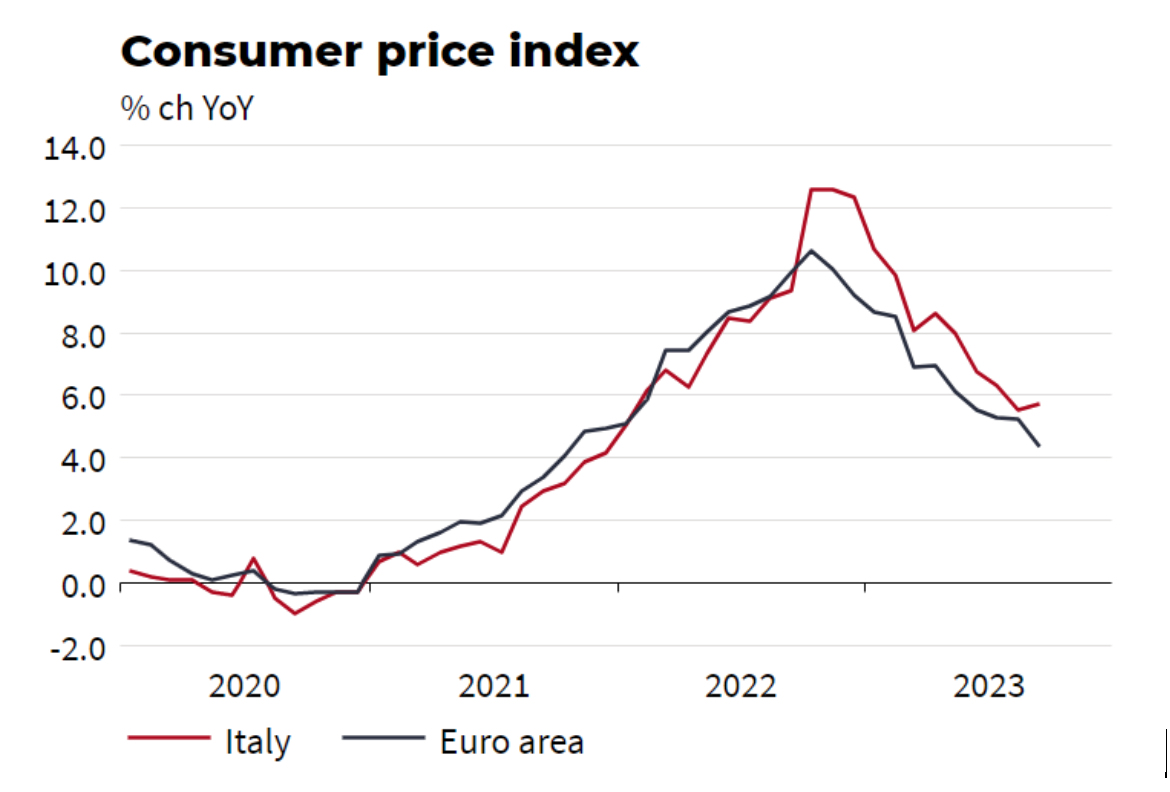

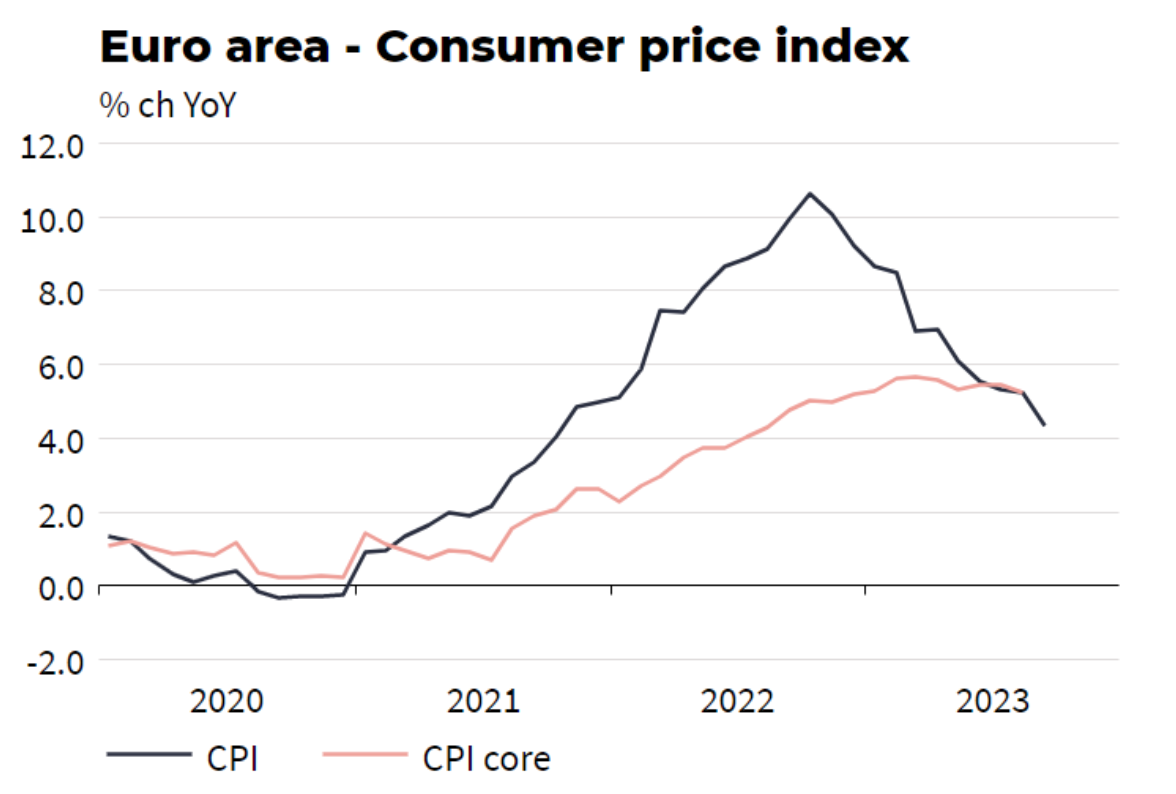

Over the last twelve months the inflation rate in the euro area declined, from a 10.6% peak in October 2022 to 4.3% last September. Net of the more volatile components such as energy and food products, the decline was more limited (from a 5.6% height in March 2023 to the recent 4.3%: see Figures 1 and 2).

Figure 1

Figure 2

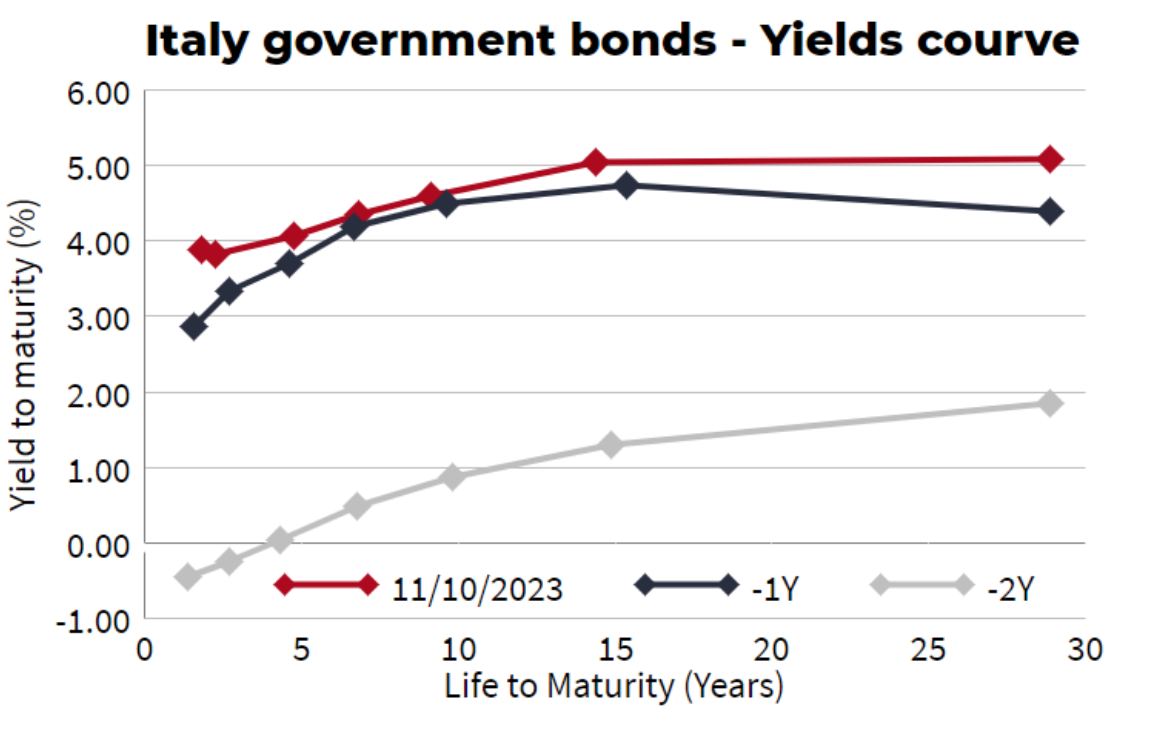

The long series of interest rate increases implemented by the ECB and the reduction of its balance sheet is starting to produce its effects. The increase in official interest rates has affected the whole yield curve.

The 10 year rate on German government bonds rose to 2.82% in early October 2023, up from -0.13% two years earlier. In the same period, the rate on Italian 10 year BTPs went from 1.3% to 4.85% (Fig. 3). The evolution of market rates will crucially depend on the speed of convergence of the inflation rate towards the 2% objective.

Figure 3

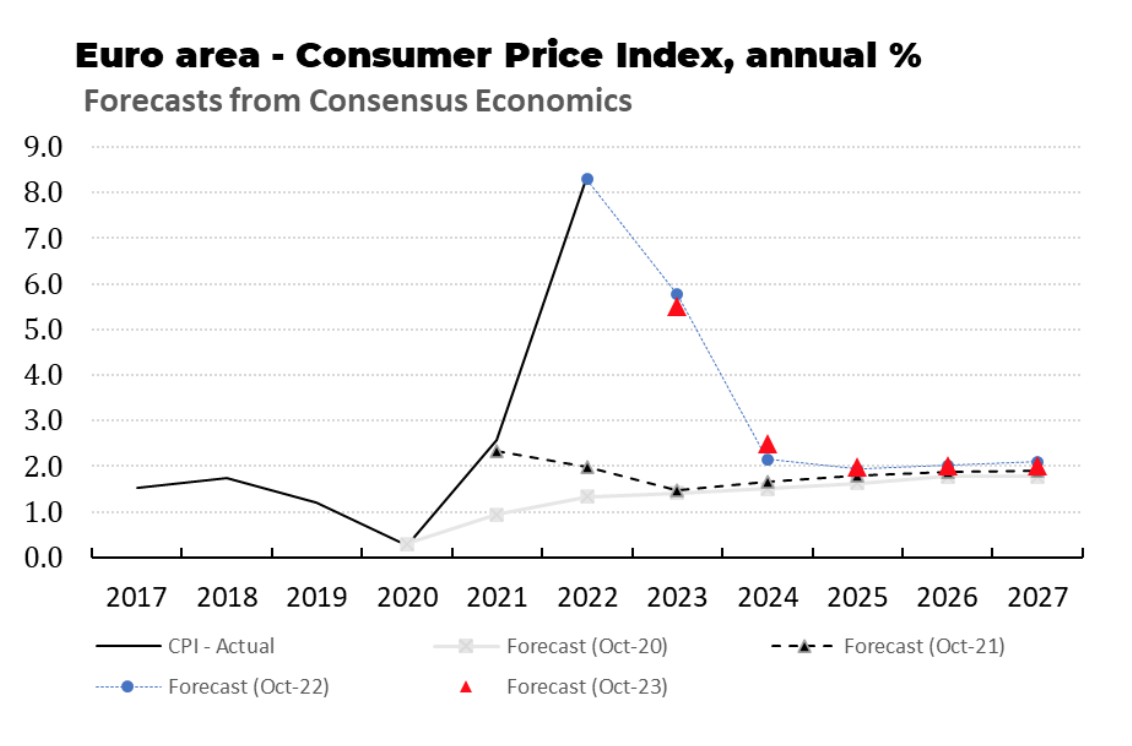

In this context, the ECB will be reluctant to cut interest rates unless it will be convinced that the euro area inflation rate has fallen sufficiently close to the target and expected to remain there in a lasting and credible manner. Based on analysts' consensus forecasts, the inflation rate in the euro area is projected to fall below 2.5% in Autumn 2024; this implies a persistence of policy interest rates at current levels for at least one year.

Such a forecast is influenced by multiple factors: the prices of energy raw materials, which remain high (for example, gas and oil), the effects of climate change on the prices of agricultural products, etc. There is also a high uncertainty concerning the transmission of monetary policy and the rigidity of the price adjustment mechanisms, even in the face of inflationary expectations that appear to be anchored at 2%.

Figure 4

In light of the heightened uncertainty, markets may continue to experience significant asset price volatility, especially in the fixed-rate segment. Long-term rates may rise at each favorable growth news, in the expectation that this will lead to further rate hikes by central banks or to rates staying higher for a longer period of time.

Negative growth news, such as the outbreak of the tragic conflicts in the Middle East, tend on the contrary to depress long-term rates in the expectation that central banks will loosen their policies to stimulate the economy.

Based on the assumptions regarding interest rates, GDP growth and public budget balances, the Government forecasts an increase in the interest payments on debt from 3.8% of GDP in 2023 to 4.2% in 2024 and 4.6% in 2026.

The calculation is based on the yield curve on Italian government bonds prevailing in the weeks preceding the preparation of the Nadef. This seems to be an overly optimistic estimate, given that 10-year BTP rates increased by approximately 50 basis points between mid-September and mid-October 2023.

Budgetary policy

Following the upward revision of the tax credits relating to the Superbonus and the Facade Bonus, which ISTAT recently estimated at 2.8% of GDP, the trend estimate of the public deficit for the current year was raised by 0.7% of GDP.

In view of the recent events affecting the geopolitical situation, the Italian government asked Parliament for authorization to revise upwards the deficit/GDP ratio: to 5.3% this year, 4.3% in 2024, 3.6% in 2025 and 2.9% in 2026.

The data are summarized in Fig. 5. In this scenario, the Italian public deficit remains above 3%, as a percentage of GDP, in the next two years and falls below the threshold only in 2026. This implies that, in the years 2024-26, the ratio between public debt and GDP will drop imperceptibly: from 140.2% at the end of 2023 to 139.6% in 2026.

There is therefore a high probability that next year – the end of the suspension of the Stability Pact – the European Commission will open an excessive deficit procedure against Italy – unless of course this is prevented by the adoption of a new economic governance system. This is likely to have a negative impact on international investors' assessments of the sustainability of Italian public debt.

Markets reacted negatively to the new budget path, also in light of some reckless measures enacted by the Italian government (such as the impromptu tax on banks’ net income margin), which raised fears about the broader national regulatory framework.

The spread on Italian government bonds now stands at 200 basis points. Markets concerns weigh negatively on Italy’s negotiating position concerning the reform of the Stability and Growth Pact.

Figure 5: Programmatic trend of the deficit and public debt

Source: September 2023 NADEF

The deficit path projected by the Nadef does not appear to be sufficiently expansive to stimulate Italian growth nor sufficiently realistic to ensure a sustained reduction on the debt-to-GDP ratio, since it is based on overly optimistic macroeconomic expectations. The government estimates that the higher budget deficit could raise Italian GDP growth by only 0.2 percentage points in 2024 and 0.1 in 2025.

Most of the commitments made before the elections have been disregarded. However, given very optimistic macroeconomic expectations, the Italian government cannot use this as an argument for a more expansionary fiscal policy. Failure to implement the programmatic path designed by Nadef risks bringing out its contradictory and negative effects for the Italian economy.

Although the Parliamentary Budget Office (PBO) has decided to validate the program forecasts put forward by the government, it stressed that the underlying GDP growth rate is higher than the main forecasters.

As already mentioned, the recent World Economic Outlook published by the International Monetary Fund (IMF) lowered the growth estimates of the Italian economy for the 2023-24 period to 0.7%, which is about half the growth rate planned by the government. Under this assumption, the Italian public sector deficit would be higher than projected by the Government by around 0.2 or 0.3% of GDP. This would jeopardize the symbolic reduction in public debt in relation to GDP.

In its hearing before Parliament, the PBO recalled other factors that could further undermine the realism of the assumed reduction of the debt/GDP ratio. These include: the obstacles to the full and efficient use of the funds made available by the Recovery and Resilience Facility in 2024-26 and the assumed privatizations.

The revision of the Italian NRRP, approved by the government in August 2023, concentrates the implementation of the projects in the last two years of the program and therefore makes it difficult to have a positive impact already in 2024.

This leaves little margin to compensate for a possible cyclical worsening of the economy and risks causing bottlenecks on the supply side and crowding out other investments.

As for the second issue, the government announced the objective of selling public assets equal to one percentage point of GDP (i.e. around 20 billion euro).

These revenues from privatizations, which should compensate for the increase in public debt resulting from the infamous tax credits for the Superbonus and the Facade Bonus, appear to be quite difficult to achieve at the very least.

These fragilities are exacerbated by the government's assumptions on the dynamics of interest payments on public debt. The Italian government expects an increase in interest expense on debt from 3.8% of GDP in 2023 to 4.2% in 2024 and 4.6% in 2026.

The calculation is based on an estimate of interest rates which is no longer credible: it is sufficient here to recall the increase of around 50 basis points which occurred between mid-September and mid-October 2023 in the yields on ten-year government bonds issued by Italy. Now, this factor likely represents the most acute risk for the evolution of Italian public debt.

Finally, the question remains whether the budget outlined by the Italian government is credible with regard to the announced objectives of containing public expenditure. The new "spending review" exercise is likely to be in a collision course with the higher growth of pension and welfare spending compared to GDP, and with the commitments for the renewal of public employee wage contracts.

There seems to be no serious spending review in sight, aiming to redefine the composition of public expenditure with the triple objective of strengthening the welfare state, reducing current expenditure and terminating rent-seeking positions.

The European policy framework

The political agenda underlying the Meloni government is strongly conditioned by the European elections in June 2024. These elections represent, indeed, an opportunity to consolidate the strength of the center-right parties.

On the other hand, the internal competition between the different parties fuels tensions that reverberate on the budget process. The Prime Minister's choice on how to approach the European Union and Italy’s partner countries fits into this framework.

The ongoing negotiations on the revision of the rules of European fiscal governance may also influence the government's choices.

The negotiations are based on the contrast between the European Commission's proposal, characterized by bilateral negotiations with individual countries on the basis of an initial “technical” proposal from the Commission itself on the debt sustainability trajectories of individual countries; and a recent proposal coordinated by the Spanish and Dutch governments that introduces “escape clauses” that apply to all countries, intended to limit the power of the Commission.

Of particular importance is the negotiating position of the German government, which opposes entrusting flexible tax compliance assessments to the Commission. The distance between the different positions could increase uncertainty in the financial markets. Investors are also evaluating the possibility of a no-deal and a return to the previous rules of the Stability Pact.

In the coming months, the market pressure on high debt EU countries is likely to mount, also in light of the difficulties to reach an agreement between member states on the numerous issues on the negotiating table, such as: new rules for economic governance; immigration; the enlargement of the Union.

The parties supporting the government may be tempted to adopt an antagonistic position with respect to the EU on all these issues. However, this could raise concerns among investors, which could ultimately generate destabilizing forces within the Italian political system.

Conclusions

Our analysis indicates that the budgetary documents presented by the Italian government are based on excessively optimistic forecasts regarding GDP growth, the effectiveness of budgetary measures and the revenues connected to privatizations. As a result, the very small projected decline in the public debt/GDP ratio is not likely.

The lack of realism in the commitments made by the Italian government to raise the primary surplus in the coming years increases the risks surrounding the sustainability of the debt. This may also have a negative impact on the negotiations for the revision of European fiscal rules aimed at giving greater ownership to national authorities in defining their budgetary policies.

Unless the public finance objectives contained in the Nadef are revised, in order to make the reduction of public debt more credible, the risks of financial instability for Italy may significantly increase.

IEP@BU does not express opinions of its own. The opinions expressed in this publication are those of the authors. Any errors or omissions are the responsibility of the authors.